- Navigator

- Business Retention and Expansion (BRE)

Like many of you, I first learned about business monopolies and our country’s antitrust laws in middle and high school. I am also old enough to remember when the federal government forced Ma Bell (AT&T) to break up into seven smaller, regional companies in the early 1980s. But I really didn’t think much about monopolies after that.

Fast-forward to this century and things have changed. In the last 10 years, the federal government has filed multiple high-profile antitrust lawsuits against companies like Google, Amazon, Visa, Facebook/Meta, and more. According to a recent Bloomberg article, the US government has more pending antitrust cases now than it did in the early 1900s when our antitrust laws were first established.

In 2024, it was big news where I live in Washington state when two judges blocked the proposed merger of the Kroger and Albertons grocery companies. That is because Kroger and Albertsons are now the last two “traditional” neighborhood grocery store chains left in our community after multiple acquisitions and mergers of other chains by both companies over the past few decades.

With the cost of groceries skyrocketing since the pandemic, shoppers were justifiably concerned about how this proposed merger would further impact food budgets that have already been stretched too thin. Many in my community, including myself, viewed the decision to stop the merger with relief.

This case study in my own backyard reinvigorated my interest in monopolies and our antitrust laws, and I started doing more research about it in my spare time. Here is a high-level summary of what I learned.

What Are Business Monopolies?

A monopoly is formed when one company controls the entire market for a particular product or service. This company becomes the only option for consumers, and without competition, it can charge any price it wants, reduce quality, and/or limit choices without fear of losing customers. The primary motivations for forming monopolies are profit and power.

Monopolies can be created using both mergers and acquisitions.

A merger occurs when two separate companies merge to form a single entity. One example of this is when Kraft Foods and The H.J. Heinz Company merged to become The Kraft Heinz Company in 2015. Not all mergers create monopolies, but those that do (usually referred to as horizontal mergers) occur when businesses that directly compete with each other decide to join forces.

An acquisition occurs when one business buys another, the buyer absorbs the purchased company’s assets, and the purchased company then ceases to exist. Acquisitions can be friendly or hostile.

Hostile acquisitions (or “takeovers”) happen when a company buys a majority of the target company’s stock shares or makes an offer to shareholders without the approval of the company’s executives.

Examples of acquisitions include InBev’s hostile takeover of Anheuser-Busch in 2008 and AT&T’s friendlier acquisition of Time Warner in 2018.

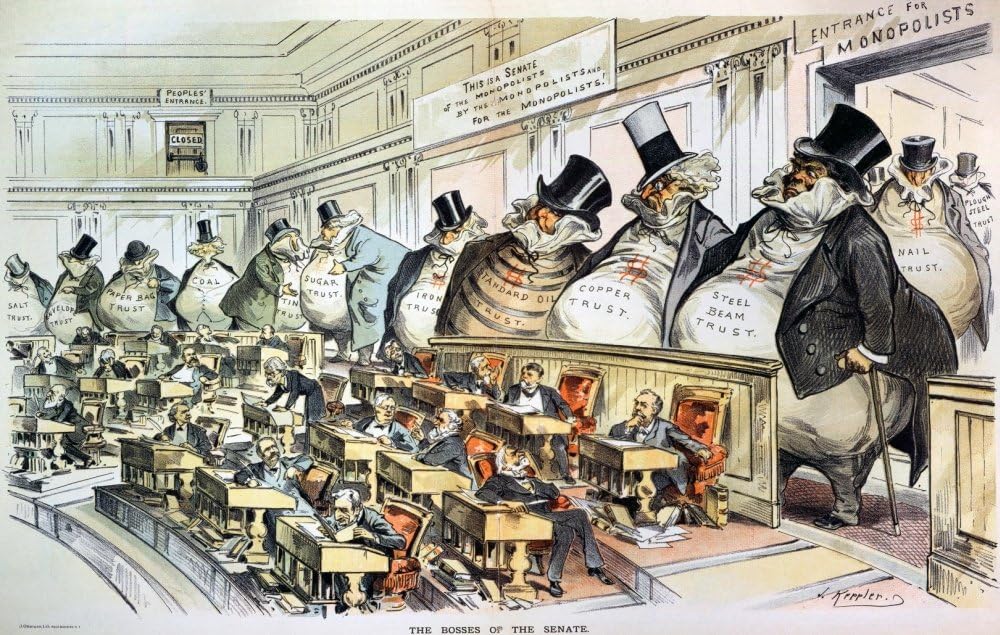

“The Bosses of the Senate” by Joseph Keppler was first published in Puck magazine on January 23, 1889. It illustrates the concerns people had about the influence large industry “trusts” had over American politics at that time.

Why Are Monopolies Bad for Consumers and Our Economy?

Monopolies disrupt the balance of a competitive market, which harms consumers and our country’s economy in six ways:

1. Higher Prices

Without competition, monopolies can set prices as high as they want knowing their customers have no other options.

2. Lower Quality and Reduced Efficiency

Competition pushes companies to improve products, offer quality customer service, and operate efficiently. Without it, there’s little incentive to do anything better or differently.

3. Fewer Choices

If one company controls an entire market, you’re stuck with their product or service whether you like it or not.

4. Barriers to Entry

When one company controls an entire market, it’s nearly impossible for new businesses to compete and survive. This lack of competition slows innovation and economic growth. In a competitive market, companies strive to outdo each other, which often benefits customers and consumers.

5. Unfair Power Dynamics Affecting Other Areas of the Economy

Monopolies can wield too much influence over suppliers, distributors, customers, and even governments. This power imbalance can lead to policies and practices that benefit the monopoly at the expense of others.

6. Job Losses

When companies are merged or acquired to form a monopoly, the consolidation typically has direct local and regional economic impacts, including closing stores/facilities/factories and laying off workers.

How Does the US Government Regulate Monopolies?

Antitrust Laws

The federal government regulates monopolies through antitrust laws aimed at preventing anti-competitive behavior, promoting market competition, and ensuring consumer welfare. They include:

The Sherman Act (1890) is the cornerstone antitrust law in the US. It prohibits any contract, combination, conspiracy, or monopoly that restrains trade or commerce. This includes banning anti-competitive agreements and price fixing.

The Clayton Act (1914) supplements the Sherman Act by addressing more specific anti-competitive practices, such as price discrimination, exclusive dealing arrangements, and mergers that reduce competition.

In addition, most states have their own antitrust laws, which are enforced by state attorneys general or private plaintiffs. In the case of the Kroger-Albertsons merger in my community, both the federal government and the State of Washington filed separate antitrust lawsuits against the company that were tried at roughly the same time in different courts.

Enforcement Agencies and Processes

The Federal Trade Commission (FTC) and the Department of Justice (DOJ) are tasked with enforcing our country’s antitrust laws and addressing instances of unfair competition and deceptive business practices.

These two enforcement agencies tend to focus on different industries or markets and consult with each other before opening new investigations to avoid duplication of effort.

Premerger notification filings, correspondence from consumers or businesses, Congressional inquiries, or news reports about consumer or economic subjects can trigger a federal antitrust investigation by either agency.

If the investigation reveals that antitrust laws have been violated, the agencies may attempt to negotiate with the company to rectify the situation through a consent agreement. If the company is unwilling to do that, the federal government may initiate formal legal proceedings similar to a federal court trial but before an administrative law judge. Like a typical court case, evidence is presented by the plaintiff (the government agency) and the defendant, testimony is given, and witnesses are examined and cross-examined.

If the judge determines antitrust laws have been violated, a cease-and-desist order may be issued or the judge may ask the agencies and the company to submit potential remedies and then determine what steps will be taken. The company can then appeal the judge’s decision. In successful appeals, the judge’s decision may be overturned completely or the penalties reduced.

One prominent example of an antitrust lawsuit overturned on appeal was United States v. Microsoft in 1998. In this case, an administrative judge found that Microsoft violated antitrust laws by bundling its Internet Explorer web browser with its Windows operating system, creating a monopoly in the browser market. The judge ordered Microsoft to split into two companies, one to produce its operating system and one to produce other software components. Microsoft successfully appealed the decision in 2001 and negotiated a much less severe consent agreement with the DOJ.

US antitrust laws have evolved over the last 100 years to address different types of market challenges, but their effectiveness in today’s digital economy continues to be debated. While these laws successfully broke up several large monopolies in the 1900s, like Standard Oil and AT&T, their success in regulating modern high-tech companies like Google, Amazon, and Facebook has been mixed.

Recent Antitrust Lawsuits in the News

There have been several high-profile antitrust lawsuits over the last few years, including:

Google (2020)

The DOJ filed a lawsuit against Google, accusing it of illegally monopolizing the search engine market by paying other companies like Apple and Samsung billions of dollars a year to make Google/Chrome the default search browser on their smartphones and web browsers.

Current Status: In August 2024, a federal judge ruled that Google had illegally maintained a monopoly for online search and asked the DOJ and Google to present potential remedies. The DOJ submitted its proposed remedy to the judge in November, which requires Google sell Chrome. Google submitted its proposed remedy in December, where it would not divest or stop entering into agreements with other companies but would require its partners give users the ability to switch their default search provider at least once a year. In August 2025, the judge ordered Google to provide its search data to qualified competitors. The ruling also placed restrictions the payments Google makes to ensure its search engine gets prime placement in web browsers and on smartphones. Google is expected to appeal the decision.

Amazon (2023)

The FTC and 17 states filed an antitrust lawsuit against Amazon, accusing it of using a set of interlocking anticompetitive and unfair strategies to illegally maintain a monopoly over the online retail market.

Current Status: This lawsuit was filed in fall 2023 and the trial is currently not scheduled to start until February 2027.

Google (2023)

The second DOJ antitrust lawsuit against Google accuses them of illegally monopolizing the digital advertising market and making it harder for rivals to compete.

Current Status: In April 2025, a federal judge ruled that Google had violated antitrust law by monopolizing digital advertising markets. The judge has not yet determined what penalties or actions Google will need to take. He will do so after the DOJ and Google submit their proposed remedies.

Apple (2024)

In March 2024, the DOJ, 16 states, and the District of Columbia filed an antitrust lawsuit against Apple, accusing it of illegally preventing other companies from offering apps that compete with the ones it provides on its iPhones, blocking cloud-streaming apps, and undermining messaging across smartphone operating systems.

Current Status: The lawsuit was filed in March 2024 and has not yet gone to trial. In November 2024, Apple asked a federal judge to dismiss the case. The judge rejected the motion in June 2025. A start date for the trial has not been announced.

Visa (2024)

The DOJ filed a lawsuit accusing Visa of monopolizing the US debit network market and incentivizing would-be competitors to become partners instead.

Current Status: The lawsuit was filed in September 2024. In June 2025, a federal district court denied Visa’s motion to dismiss the case. A trial start date has not yet been announced.

Live Nation-Ticketmaster (2024)

In May 2024, the DOJ and 30 states filed a lawsuit accusing Live Nation-Ticketmaster of unlawfully maintaining monopolies in several concert promotions and primary ticketing markets and engaging in other exclusionary conduct, including threatening financial retaliation against a competitor and blocking venues from using multiple ticketing companies.

Current Status: In August 2024, 10 more states joined the lawsuit, and the DOJ filed an amended complaint. It is expected that the trial will begin in March 2026.

What Can Economic Developers Do to Promote Healthy Business Competition?

Economic development professionals play an important role in creating strong, diverse economies within their communities and regions. Here are some ways you can contribute to fostering a fair and competitive marketplace that benefits businesses and consumers:

- Encourage Diverse Business Growth: Support the development of small and medium-sized enterprises (SMEs) to ensure a balanced market where no single entity dominates.

- Facilitate Fair Market Entry and Expansion: Assist startups and existing businesses that are ready to expand with resources, funding, and infrastructure to create a competitive landscape.

- Advocate for Inclusive Procurement Practices: Encourage governments and large businesses to adopt procurement policies that prioritize competition and support other local or regional businesses.

- Offer Fair Economic Incentives: Structure incentive programs and subsidies to avoid giving unfair advantages to dominant market players. Invest in innovation hubs, incubators, and accelerators that provide equal opportunities for diverse businesses.

- Monitor Industry Consolidation: Monitor local/regional mergers and acquisitions and share concerns about the potential formation of monopolies with local elected officials and federal antitrust enforcement agencies.

Ultimately, I learned through my research that the vast majority of business mergers and acquisitions in this country proceed without incident, which is part of doing business in a free market economy. For example, the FTC and DOJ did not come knocking at our door when Camoin Associates acquired PolicyOne Research in 2010 and 310 Ltd. in 2019. Nor did they come after Microsoft when it acquired any of the 275+ companies it has purchased since 1986.

The antitrust cases that do go to trial are those in which the government has substantive evidence that companies are violating antitrust laws to cement their dominance and eliminate competition in a particular market. Combating monopolization preserves fair competition and allows smaller companies to enter the market freely. This was the ideological point behind the creation of our antitrust laws and still remains central to their enforcement today.

As consumers continue to struggle with increasing prices for many important goods and services amid dwindling competition and choices, I believe vigorous and effective enforcement of our antitrust laws remains important. By understanding what monopolies are and how they can negatively impact our economy and our wallets, we can better appreciate the importance of competition in a healthy economy.

Camoin Associates is a trusted economic development and business prospecting consulting firm that helps communities and organizations achieve sustainable and equitable growth through expert analysis, effective strategies, and intentional connections.

By providing valuable insights, best-in-class data, and personalized, actionable strategies, we empower our clients to make well-informed decisions that drive economic success and foster strong, competitive markets.

This article was originally published on December 12, 2024, and was updated by the author on September 3, 2025.