- Navigator

- Expansion Solutions

- Industry Analytics and Strategy

- Real Estate Development and Housing

- National

- Information Technology, Semiconductors, and AI

We have entered the age of the tech and digitalization of everything. With the “tech of everything” there has been and continues to be exponential growth in demand for information technology and telecommunications infrastructure. Streaming, telehealth, Fintech, HealthTech, Industry 4.0, 3D printing, big data, autonomous vehicles, cloud and edge computing, AI, VR, machine learning, remote work, 5G, smart cities, wearables, and Ecommerce all have something in common: they are driving increasing demand for data storage and distribution including data centers.

What comprises a data center? Their scale, customers, networks, and processes have all changed and are continuing to change as technology and demand both rapidly increase. For purposes of this article, which focuses on business and economic development, a few basic definitions are warranted.

A data center, put simply, is a facility that houses equipment and technology for the storage of and access to data and applications. More specifically, it “is a physical facility that organizations use to house their critical applications and data. A data center’s design is based on a network of computing and storage resources that enable the delivery of shared applications and data. The key components of a data center design include routers, switches, firewalls, storage systems, servers, and application-delivery controllers.”[1]

Not all data centers are the same. They vary in size, uses, networked, technology, and scalability among other factors. The following from CISCO offers a good lay-person explanation of some of the differences:[2]

- Enterprise data centers: built, owned, and operated by companies optimized for their end users. Most often they are housed on the corporate campus.

- Managed services data centers: managed by a third party on behalf of a company. The company leases the equipment and infrastructure instead of buying it.

- Colocation data centers: a data center facility that rents spaces, equipment, and related services to multiple companies.

- Cloud data centers: in this off-premises form of data center, data and applications are hosted by a cloud services provider such as Amazon Web Services (AWS), Microsoft (Azure), or IBM Cloud or other public cloud provider.

And there are hybrids. “This evolution has given rise to distributed computing. Organizations can choose to build and maintain their own hybrid cloud data centers, lease space within colocation facilities, consume shared compute and storage services, or use public cloud-based services. The net effect is that applications today no longer reside in just one place. They operate in multiple public and private clouds, managed offerings, and traditional environments. In this multi-cloud era, the data center has become vast and complex, geared to drive the ultimate user experience.”[3]

Data Center Industry Trends

With a basic understanding of what a data center is and can be and given the ever evolving technological and supply and demand environment, let’s now take a look at industry market trends.

Real Estate Trends

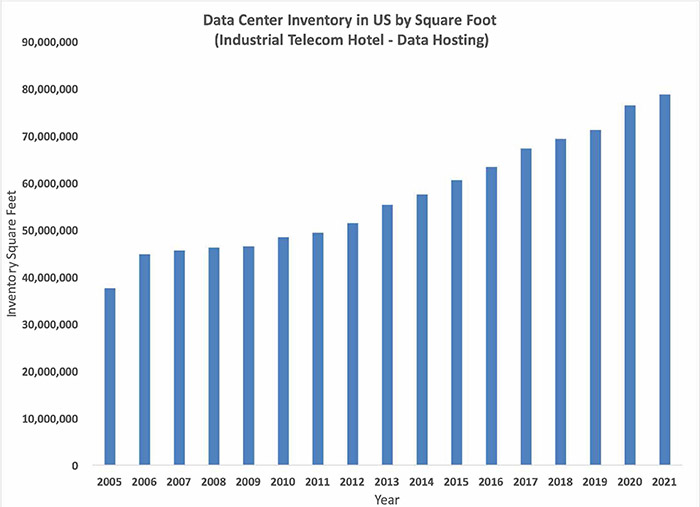

Data center (building space) inventory has been increasing steadily starting with the recovery from the 2008 recession and has experienced even further increases in 2020 and 2021. Data from CoStar on industrial telecom hotels (typically large-scale single-site data centers) indicates in 2008 there were 46 million square feet of inventory. This increased steadily following 2010 (the start of the recession’s recovery) to 71 million in 2019 and has further increased in 2021 YTD to 79 million square feet. (See Figure 1) [4]

Figure 1

Source: CoStar

Source: CoStar

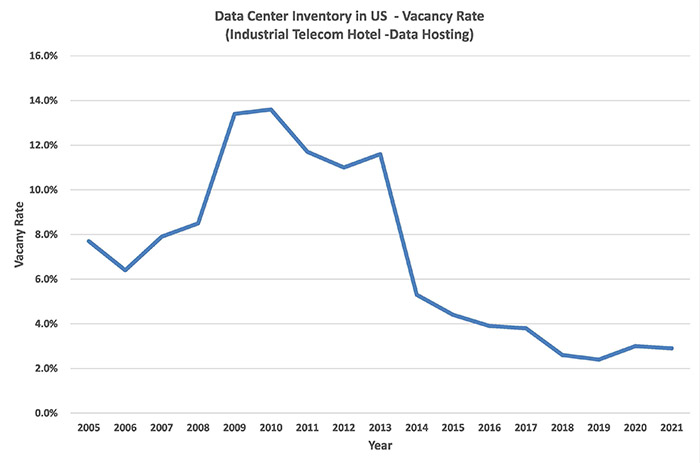

In terms of vacancy rates, supply has not kept up with demand since the recovery from the 2008 recession. From a vacancy rate of 8% for industrial telecom hotels in 2008, rates rose and remained at levels between 11% and 13%. Rates then declined in response to the recovery from the recession as demand and investment occurred, reaching 2.4% in 2019, and have stayed low at around 3% through 2021 YTD. (See Figure 2) [5]

Figure 2

Source: CoStar

Source: CoStar

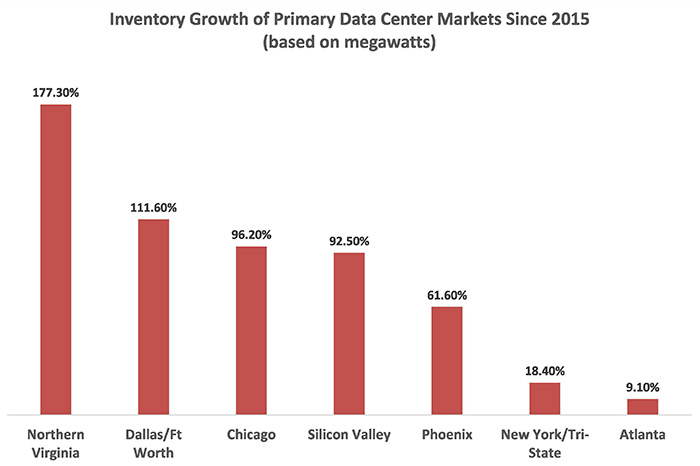

In terms of regional growth in data center capacity and projects since 2015 and to 2020, Northern Virginia, which includes Ashland and surrounding Loudoun County and is known as “Data Center Alley,” as well as Prince William County, have experienced the largest percent of growth with 177% increase in megawatts.[6] This was followed by Dallas/Fort Worth (112%), Chicago (96%), Silicon Valley (93%), and Phoenix (62%). (See Figure 3)

Figure 3

Source: CBRE Research, CBRE Data Center Solutions, H1 2020

Source: CBRE Research, CBRE Data Center Solutions, H1 2020

In terms of specific real estate market trends, CBRE reports that COVID had an impact on the market especially in terms of very large, data driven companies. “Hyperscale companies, large cloud service providers and content providers leased space in wholesale colocation facilities to meet a spike in demand from their customers during the COVID-19 pandemic.”[7] They go on to provide the following trends and questions to watch, all based on the diversity and complexity of the market to meet increasingly varying needs and scale of customers:[8]

- Will hyperscale companies continue to take space in wholesale colocation facilities, move back to more traditional hyperscale facilities, or will they continue to leverage both?

- Will asking rates remain stable or will there be increased bifurcation of pricing trends between large hyperscale users and smaller enterprise clients?

- Cloud Migration: How will increased cloud services affect the leasing numbers for enterprise users who have decided to migrate to a hybrid IT approach?

JLL, a national real estate leader with strong data center services and portfolio, further adds to insights and trends to watch for, including:[9]

- “The pandemic had a significant impact on data center sector demand and investment. After a pandemic-induced record year for demand in 2020 as streaming services and virtual connectivity skyrocketed.”

- “Demand is on pace for another strong year for data centers in 2021. Cloud, technology, and social media companies continue to drive near-record levels of demand across the globe.”

Industry Economic Trends

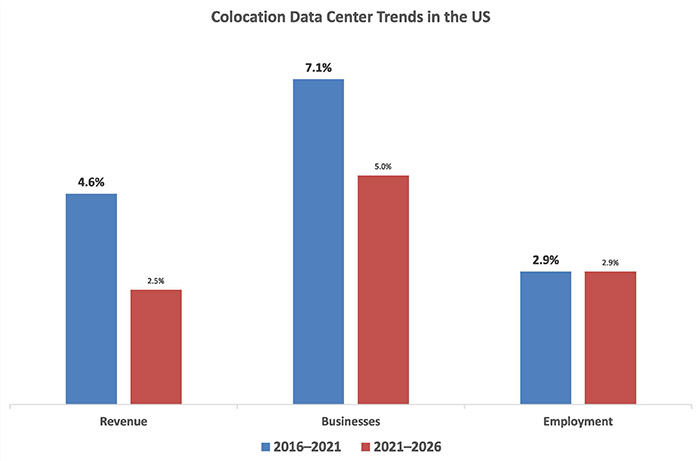

While data centers are not typically employment intensive, they do contribute significantly to the economy and also are a critical infrastructure for all industries. IBISWorld, a leader in industry sector market research, reports specifically on the colocation data center sector. They report robust growth since 2016 through 2021 driven by growth in online activity and investment in computer hardware and software as all sectors become more and more digitally driven. “Over the five years to 2021, the percentage of business conducted online is expected to rise at an annualized rate of 6.4%, while private investment in computers and software is expected to increase at an annualized rate of 7.8%, indicating a heightened need for server storage. As a result, IBISWorld anticipates industry revenue to increase an annualized 4.6% to $13.2 billion over the five years to 2021.”[10]

In 2021, IBISWorld estimates that the colocation data center industry in the U.S. consists of:

- $13.2 billion in revenue

- 535 businesses

- 36,885 employment

- Major companies include Equinix Inc. with 21.2% market share and Digital Realty with 2.5% market share

This growth is also projected to continue, IBISWorld is estimating annual growth through 2021 at levels of 4.6% for revenues, 7.1% in businesses, and 2.9% in employment with growth projected to continue on all these economic indicators. The projected lower growth rates are less related to industry factors and markets specifically and more related to a projected slowdown in the spike of demand driven by COVID, a spike in online activity, and an overall slowdown in annual economic growth overall. (See Figure 4)

Figure 4

Source: IBISWorld

Source: IBISWorld

Trends Impact the Industry Going Forward–Sustainability–Green and Clean

Going forward there are multiple trends across our economy, technology, and culture that will continue to impact and even increasingly impact data center real estate and industry markets. Here we focus on one such trend: a cultural and related market shift towards green and sustainable development.

Data centers have a reputation for being power hungry, energy users and as culture and economy shift in favor of climate change impact mitigation and sustainability, the market is seeking green initiatives. Data centers are no exception and the market is heeding the call. As reported by Wired, a study published in the journal, Science in 2020 found that through energy efficiency initiatives data centers have been able to grow more sustainably. “In 2010, data centers around the world consumed roughly 194 terawatt-hours of energy, or 1% of worldwide electricity use. By 2018, the compute capacity of data centers increased sixfold, internet traffic grew 10-fold, and storage capacity rose by a factor of 25. But the study finds that over this time data-center energy use grew just 6%, to 205 tWh.”[11]

This trend is likely to continue. “In a recent survey of 825 Multi-Tenant Data Centre (MTDC) operators by S&P, about 43% said they have a strategic sustainability initiative in place to improve their data center builds and operations in a comprehensive fashion.”[12] Those plans will lead to changes in investment and related builds and, operators without plans will increasingly put ones in place as culture and economy continue to drive change.

Changes being adopted by the data center industry for green sustainability are varied and range from use of renewables, LEED certification, use of sustainable building materials, power, and water usage effectiveness, and more. Progress by Equinix, the largest colocation data center company, and by CyrusOne, a high-growth real estate investment trust (REIT) specializing in data centers, exemplify changes in the industry. “Equinix has over 16 million square feet of LEED certified and other sustainable certified data center space. It increased its renewable energy use from 34% in 2015 to over 90% in 2020. And, in addition to CyrusOne’s first net-positive water data center in Chandler, Arizona, the REIT opened its second net positive water data center in Carrollton, Texas.”[13]

In 2020 and 2021 the “greening” of data centers has been further moving from goals and concepts to reality through green financing. As reported by CoStar, “Three operators, Aligned Data Centers, Equinix and Digital Realty, have raised or issued $2.35 billion in green financing. While Aligned secured $1 billion in green loans from a group of bankers, Equinix and Digital Realty turned to global investors seeking green bonds.”[14] Further as reported by CoStar, “Dallas-based Aligned, a leading data center provider, established a data center-backed securities platform and issued $1.35 billion in bonds. The offering is the latest example showing investors’ willingness to put money toward efforts aiming to combat climate change.”[15] The related projects entail four wholesale data centers in Texas, Arizona, Utah, and Virginia and comprise $1.77 billion in investment, 141 megawatts of capacity, and 1.5 million square feet of gross data center space.

What this means for economic development

Multiple factors will impact data center markets into the future. In this article we examined market trends, as well the current and growing trend toward green and sustainable development. Other industry factors include the growth of cloud and edge computing, 5G wireless, satellite technology, the Internet of Things, autonomous vehicles, Smart Cities and Smart Infrastructure, artificial intelligence, virtual reality, and continued changes in how we learn and work from in-person, to remote, to hybrids.

While not examined in depth here, each of these trends points to increasing demand for data storage, processing, and distribution serving all industries and societal functions. And all of this occurring across increasingly distributed and diverse networks within which data centers are a critical part. They will continue to grow in diverse ways from large hyperscale supporting major companies and big data initiatives to colocation, to local and regional centers meeting needs across multiple purposes, and within hybrid network models. All of this creates opportunity for economic development.

So, how can economic developers prepare for and leverage these opportunities? Here are three simple focus areas for customizing an approach.

1. Understand the key factors that drive investment and location in data centers

These include:

- Price of energy

- Redundancy of energy/electricity

- The availability of green energy

- Access to ICT infrastructure – including for proximity to subsea cables that carry information across oceans, to land based fiber, to facilities and equipment along the information chain of transmission, processing, and distribution

- Access to engineers and technicians (network specialists, wiring technicians, electricians, heating and air conditioning specialists, security specialists, and more)

- Safe external factors – such as low risk for natural disasters

- Available land and sites – large site sizes and the ability to acquire and gain local approval

- Nearby demand for high volume storage and transmission of data – complementary industries

No one region has all that is needed and facilities are needed across the country to meet diverse needs, so understanding where your region and locality have strengths and challenges is critical to pursuing targeted investment.

The availability of land and sites is particularly important and falls directly in the purview of local and regional economic development. It is also a major challenge. Data centers do take up space, can be noisy due to cooling, and are not labor/employment intensive. Therefore, they are subject to pushback and NIMBYism from local residents. The land they typically occupy is also under competitive pressure for logistics, warehousing, and other and industrial uses. In their data center outlook, JLL reports “Looking forward: expect increased competition with industrial players over land. Data center developers are competing with industrial developers for limited land in key markets. In the United States, land viable for data center development in Phoenix, Las Vegas, and Utah has been largely scooped up by industrial developers. There continues to be a shortage of warehouse space, pushing pricing for industrial land, which is compressing the premium a data center user and developer would typically pay for the right piece of land. Limited land availability and increased competition with industrial players may hinder expansion plans for users and operators throughout the year.”[16]

2. Understand your market fit and competitive advantage in terms of scale of data center

Data centers, as discussed, range from massive, hyperscale centers, to large single site centers, to smaller regional and local centers, to centers located in multi-tenant office environments. Each have overlapping location and investment requirements but also unique needs associated with them. Not all regions and localities can compete for all types of development, and fact most can’t. Knowing where you fit in this market so you can better target industry support and attraction will help you succeed.

3. Consider the whole “value-chain of opportunities” that data centers are a part of

Data centers are a critical part of the information and data “chain” that includes content generation and storage; distribution; security; transfer; and processing. It is in this sense that they fit within in a complex value chain similar to manufacturing supply chains. This creates multiple opportunities depending on a locations particular fit and strengths. Therefore, to leverage these, it is important to expand what you are trying to support and attract to include different types of data centers but also other related industries and companies along the data and information value chain.

A great example of this is Loudoun County Virginia. Known as Data Center Alley and part of the largest data center region in the country, Northern VA, Loudoun County through their Economic Development Department continues to support data centers but also regularly assesses emerging opportunities in highly related sectors and technologies. They then integrate this intelligence into business development strategies. This includes strategies for highly specialized manufacturing, clean energy, edge and cloud computing, data analytics, media and communications, and more. This both helps leverage opportunities related to information technology and telecommunications assets, including data centers but also helps it diversify its portfolio for long term economic growth.

Data centers will continue to be a critical asset for local, regional, national, and global economic growth as the tech of everything continues.

Jim Damicis is Senior Vice President of Camoin Associates, a full-service economic development firm (www.camoinassociates.com). He is a regular industry analysis contributor to Expansion Solutions.

This article originally appeared in the January 2022 issue of Expansion Solutions.

[1] www.cisco.com/c/en/us/solutions/data-center-virtualization/what-is-a-data-center.html

[4] www.costar.com

[6] CBRE Research, CBRE Data Center Solutions, H1 2020, www.cbre.us/research-and-reports/North-America-Data-Center-Report–H1-2020

[7] Data Centers/Alternatives – 2021 U.S. Real Estate Market Outlook. CBRE – www.cbre.us/research-and-reports/2021-US-Real-Estate-Market-Outlook-Alternatives

[9] H1 2021 Data Center Outlook – Insight into the industry’s top trends in the first half of 2021 – https://www.us.jll.com/en/trends-and-insights/research/data-center-outlook

[10] INDUSTRY REPORT OD5899 Colocation Facilities, Power up: The rising cost of electric power is expected to push customers toward the industry Sean Egan, August 2021

[11] Data Centers Aren’t Devouring the Planet’s Electricity—Yet, by Will Knight, Wired, 2/27/2020

[12] JLL, H1 2021 Data Center Outlook – Insight into the industry’s top trends in the first half of 2021 – https://www.us.jll.com/en/trends-and-insights/research/data-center-outlook

[14] Data Centers Turn to Green Financing on Environmentally Friendly Projects, By Mark Heschmeyer and Candace Carlisle, CoStar News September 27, 2020

[15] Aligned Energy Raises $1.7 Billion in ‘Green’ Data Center Financing, Year’s Biggest Offering of Its Kind. By Mark Heschmeyer, CoStar News, August 30, 2021

[16] ” JLL, H1 2021 Data Center Outlook – Insight into the industry’s top trends in the first half of 2021 – https://www.us.jll.com/en/trends-and-insights/research/data-center-outlook