- Navigator

- Featured Indicator

- Industry Analytics and Strategy

- National

In the West, where I spent about 44 of my 55 years, the federal government owns close to half of the land — 46% of the 11 coterminous Western states and ranging from 29% in Washington and Montana to about 60% in Idaho and Utah and 80% in Nevada. These public lands include national parks, national monuments, national forests, designated wilderness, and Bureau of Land Management land.

In the West, where I spent about 44 of my 55 years, the federal government owns close to half of the land — 46% of the 11 coterminous Western states and ranging from 29% in Washington and Montana to about 60% in Idaho and Utah and 80% in Nevada. These public lands include national parks, national monuments, national forests, designated wilderness, and Bureau of Land Management land.

Besides recreation activities, energy and mineral production also take place on some of these public lands (mostly those overseen by the Bureau of Land Management), which generate revenues for both the federal government and the states from these types of land uses.

The US Department of Interior’s Office of Natural Resources Revenue (ONRR) publishes monthly and annual data on natural resources production on federally owned public lands and offshore areas, total revenues generated, and disbursements by commodity and state. Displayable and downloadable datasets are:

- Production: volumes (tons, barrels, cubic feet, etc.) of about 30 different commodities, including familiar products like crude oil and natural gas to lesser-known commodities like phosphate ore, zinc concentrate, and geothermal energy. Data are reported by state and county, and month, calendar year, and federal fiscal year

- Revenues: by type (royalties, bonus payments, rents, inspection fees, civil penalties, and other revenues), source (federal offshore leases, federal onshore leases, Native American lands, and federal but not tied to a lease), state and county, company, commodity, and by month, calendar year, and federal fiscal year

- Disbursements: distribution of revenues is reported by fiscal year, source (federal onshore and offshore), and recipient

What Is the Data About Public Lands Telling Us?

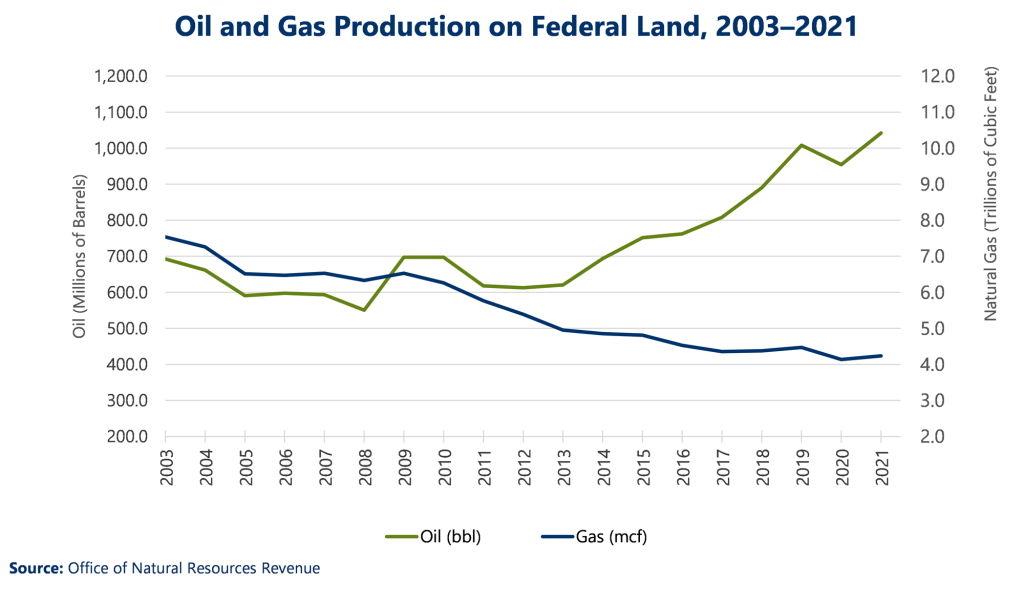

Taking oil and gas as examples, ONRR data show that oil production on federal onshore and offshore public lands has increased by 50% since 2003, reaching more than 1 billion barrels in 2021, while natural gas production has declined by 44% over the same period to 4.2 trillion cubic feet.

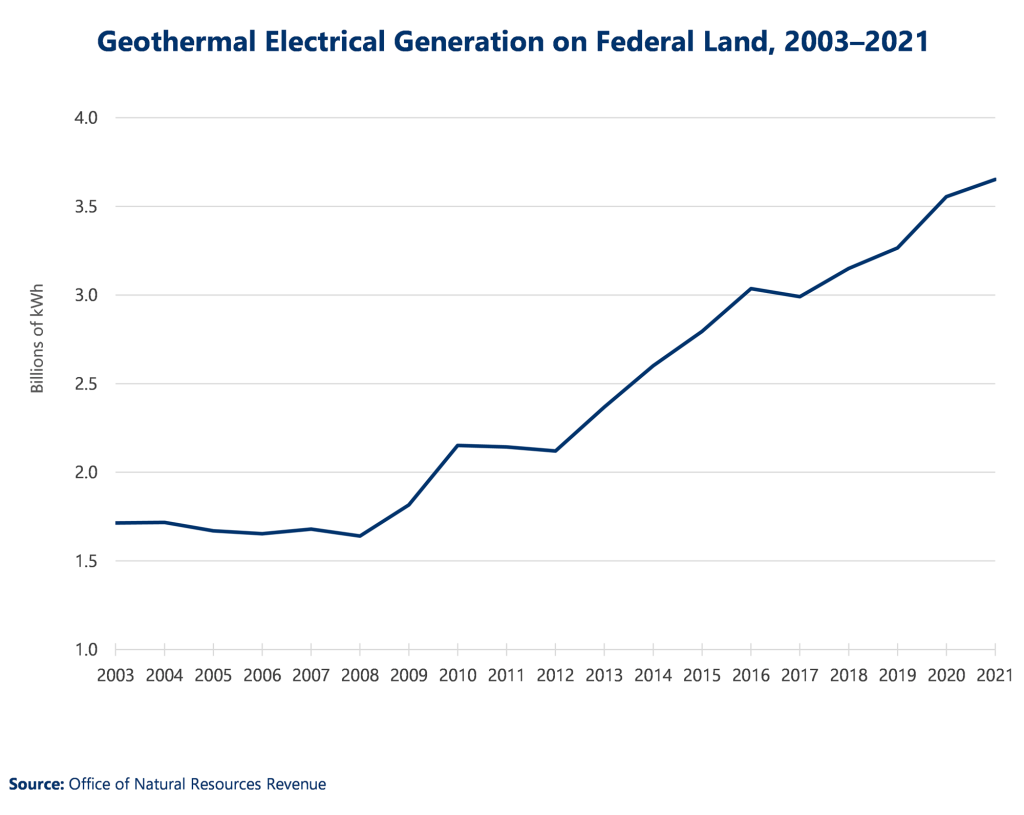

Data on renewable energy production on federal lands are available for geothermal electricity generation. The standard reporting unit is kilowatt hours (kWh), but a handful of counties report it in other units. Geothermal generation was fairly steady from 2003 to 2008 at about 1.7 billion kWh but has since more than doubled to over 3.6 billion kWh.

Data on renewable energy production on federal lands are available for geothermal electricity generation. The standard reporting unit is kilowatt hours (kWh), but a handful of counties report it in other units. Geothermal generation was fairly steady from 2003 to 2008 at about 1.7 billion kWh but has since more than doubled to over 3.6 billion kWh.

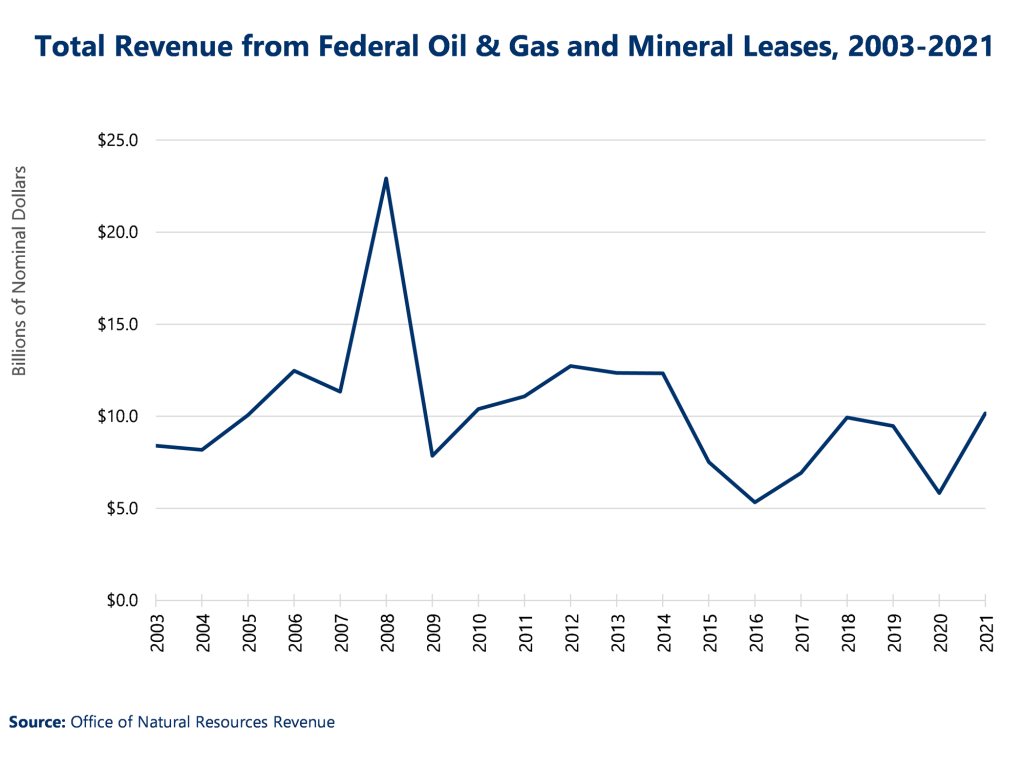

Total energy and mineral production on public lands resulted in more than $10.1 billion in revenues in 2021, $9.4 billion of which was royalties. This is on par with the 19-year average of $10.3 billion, though actual annual amounts have fluctuated between $5.3 billion in 2016 and $22.9 billion in 2008 and this does not account for the eroding effects of inflation. (The spike in 2008 was driven by a large increase in bonus payments, i.e., the winning bid on auctions of federal lease parcels.)

Total energy and mineral production on public lands resulted in more than $10.1 billion in revenues in 2021, $9.4 billion of which was royalties. This is on par with the 19-year average of $10.3 billion, though actual annual amounts have fluctuated between $5.3 billion in 2016 and $22.9 billion in 2008 and this does not account for the eroding effects of inflation. (The spike in 2008 was driven by a large increase in bonus payments, i.e., the winning bid on auctions of federal lease parcels.)

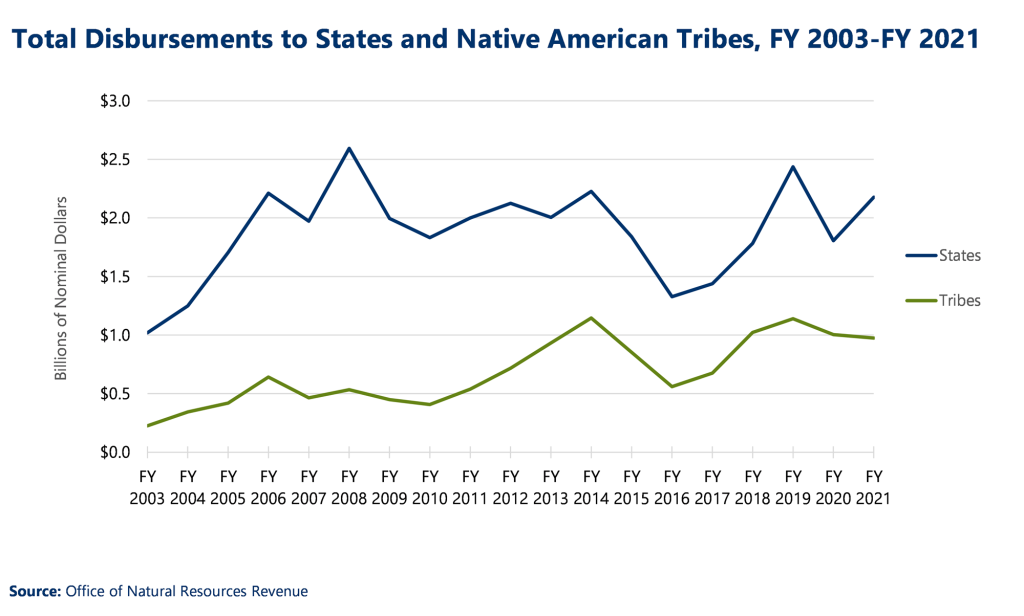

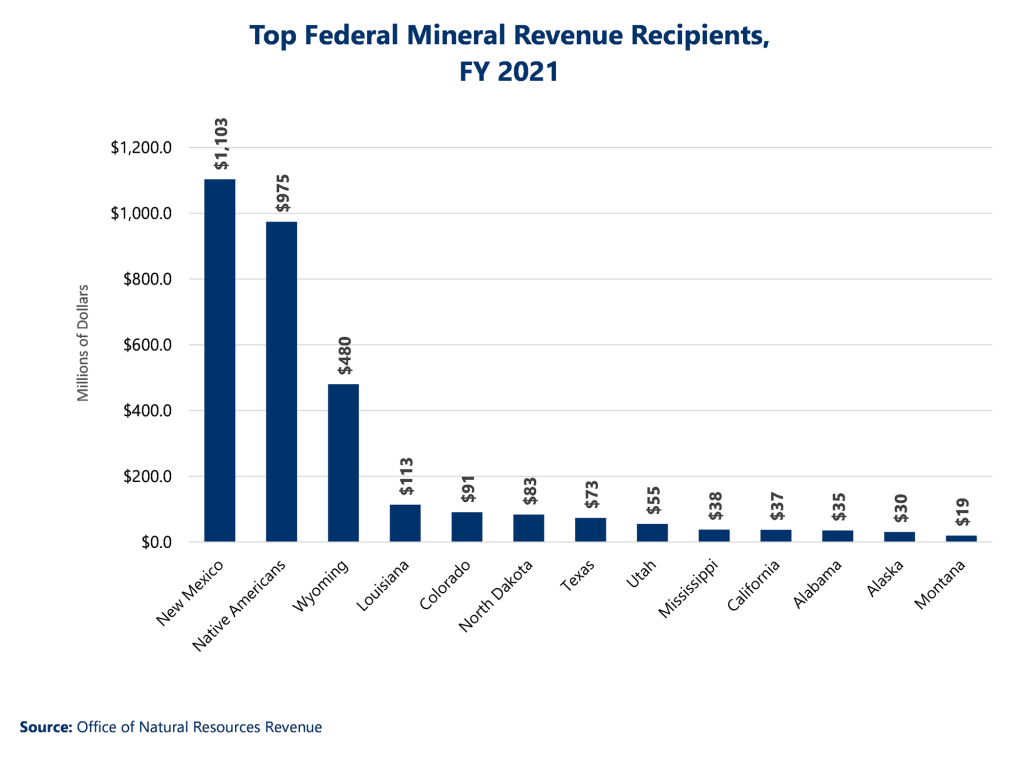

Revenues are distributed according to various formulas depending on production location and revenue type. The US Treasury, Land and Water Conservation Fund, Reclamation Fund, Historic Preservation Fund, and state and local governments all receive a portion of the revenues generated by federal mineral leases. States receive half of the revenues generated from federal onshore leases (except Alaska, which gets 90%) and a portion of offshore leases within three miles of a state’s shoreline. Native American tribes, nations, and individuals receive all the revenues from production on their lands.

Revenues are distributed according to various formulas depending on production location and revenue type. The US Treasury, Land and Water Conservation Fund, Reclamation Fund, Historic Preservation Fund, and state and local governments all receive a portion of the revenues generated by federal mineral leases. States receive half of the revenues generated from federal onshore leases (except Alaska, which gets 90%) and a portion of offshore leases within three miles of a state’s shoreline. Native American tribes, nations, and individuals receive all the revenues from production on their lands.

In the federal fiscal year (FY) 2021, 33 states received a total of almost $2.2 billion in federal mineral lease revenues and Native American tribes and individuals received $974.6 million. These are 114% and 334% higher, respectively, than in FY 2003. The recipients of the largest revenues were New Mexico with $1.1 billion and Wyoming with $479.9 million.

Why Is it Important?

States have a great deal of flexibility in how they spend federal mineral lease funds, and they can represent an important source of infrastructure and other economic development investment. For example, the State of Utah distributes its federal mineral revenues to several recipients, including the Utah Department of Transportation, the Permanent Community Impact Fund, the Department of Workforce Services, the State Board of Education, the Utah Geological Survey, the Water Research Laboratory, and the Wildland Fire Suppression Fund. Most of the revenues are targeted at counties impacted by oil and gas and mineral production.

Oil and gas production generated 95% of the revenues in 2021, with coal contributing another 4%. If we continue to move away from the use of domestically produced fossil fuels, their associated revenue streams will dwindle, with significant impacts for many, mostly rural communities.