- Navigator

- Northeast

- Industry Analytics and Strategy

- Retail, Services, and Accommodations

“Marriage is a wonderful institution, but who wants to live in an institution?” — Groucho Marx

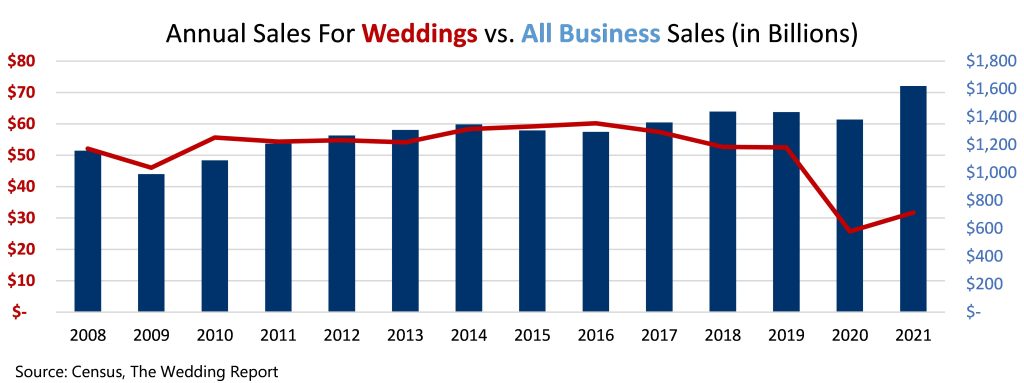

Many who work in the wedding industry are not in a humorous mood these days. According to The Wedding Report, annual sales for weddings cratered to $25.7 billion in 2020 and rebounded only slightly in 2021 to $31.7 billion. This is barely half of 2016’s recent peak of $60.1 billion and while forecasts for the current year do provide room for optimism, the damage has been done.

According to The Wedding Report, annual sales for weddings cratered to $25.7 billion in 2020 and rebounded only slightly in 2021 to $31.7 billion. This is barely half of 2016’s recent peak of $60.1 billion and while forecasts for the current year do provide room for optimism, the damage has been done.

Vows Broken?

In 2020, nearly one million weddings were canceled in the US alone. The COVID-19 pandemic has left its mark on every institution and has had far-reaching impacts that are both cultural and economic. Would-be brides and grooms abandoned plans (and deposits) as factors such as health precautions, regulatory restrictions, or changing availability of vendors forced rescheduling and many outright cancellations.

Events that were able to go forward needed to be adjusted in scale, as well. Wedding budgets have shrunk from a pre-pandemic level of around $25,000 to just over $20,000 for 2020. The ingredients in this (20% smaller) cake are various and their changes are complicated.

The largest factor affecting wedding budgets is a reduction in the number of guests. Part of this reduction is a casualty of COVID-19-related logistics as everything from travel to making food becomes more difficult and planners try to allocate more personal space (square footage and air) to each guest.

Surveys from The Wedding Report indicate that approximately 60% of weddings canceled in 2020 were rescheduled for a future date. Those same surveys reported that more than half (58%) of couples reduced their headcount by 41% on average. Given 2019’s average wedding size of 125 guests, this means 51.3 fewer guests, steak Frites (average food catering loss: -$1,893), glasses of champagne (average bar service loss: -$970), and party favors (average favors loss: -$99).

This accounting still only relates to the reduced spending (and joy) that happened for weddings that were ultimately rescheduled. Time will tell, but the earlier survey responses indicate that about half a million weddings canceled in 2020 were not rescheduled. This permanent loss supposes a $12.5 billion deficit to the industry in 2020.

Love Delayed, But Not Denied

If there is a silver lining to such a significant economic loss, it’s that data for 2021 and sentiment for 2022 and beyond predicts a rebound for the wedding industry. The number of weddings for 2021 is estimated at 1.93 million (+660K vs. 2020 or +52%) and because many of 2020’s rescheduled nuptials occurred in 2022, a would-be record of 2.47 million weddings in anticipated for this year.

Spending on weddings is up, as well. Average spending per wedding for 2021 is up to a record high of $27,060. Many things have returned to normal and that means bigger parties are back. The average wedding size rebounded to 124 in 2021. This is a welcome reversal from the guest reductions seen in 2020. This change also represents an increase in spending per guest compared to 2019 of +10.5%. Some of this, no doubt, is exuberance on the part of now-unbridled bridal couples. But another factor is inflation.

Portland is For Lovers? A Regional Case Study

The wedding industry is an important driver of economic activity in the US economy. And the preceding trends show how it’s affected by macro events. Still, most of the vendors involved will be local small businesses. There are national industry players like Wedgewood (venues) or Kleinfeld (dresses), but the key spending categories for weddings: venue, catering, jewelry, photography, are all services that are typically provided by small businesses (less than 100 employees) or microbusinesses (less than 10 employees).

Using The Wedding Report’s market analysis for Metropolitan Areas allows a geographical focus that highlights the unique characteristics of a given region and the ways in which these local businesses have operated both pre- and post-COVID-19.

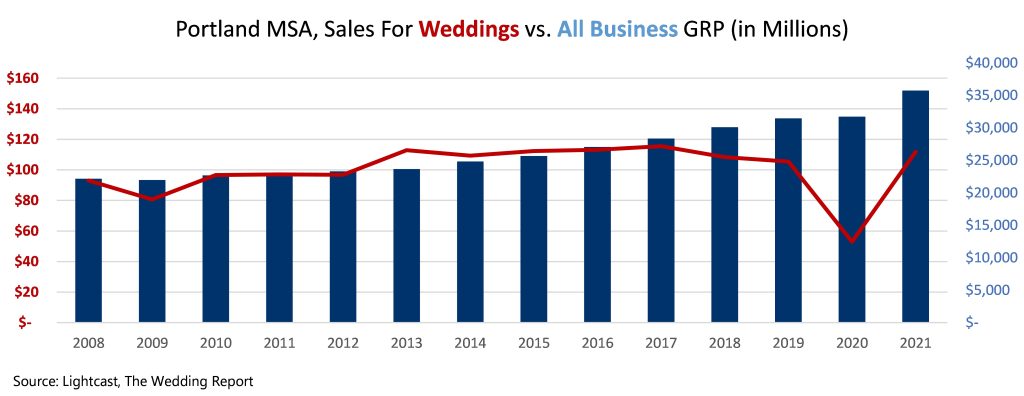

Perhaps better known for its crustacea, Portland, ME, also draws over 4,000 weddings per year with its rocky coasts, historic settings, and boutique hotels. In 2019, the wedding industry in Portland contributed $105 million in sales to the local economy and couples averaged $24,665 in spending per that year’s 4,277 events. (Coincidentally it is the hometown of this author, who also happened to marry in Maine.) Any similarities between the performance of the US and Portland wedding industries are overshadowed by a distinct difference between the two in the rate of recovery in 2021. The US saw a 23% bounce as things started to return to normal in 2021, but the Portland Metropolitan Statistical Area (MSA) saw the market rebound at +111% to surpass even 2019 sales!

Any similarities between the performance of the US and Portland wedding industries are overshadowed by a distinct difference between the two in the rate of recovery in 2021. The US saw a 23% bounce as things started to return to normal in 2021, but the Portland Metropolitan Statistical Area (MSA) saw the market rebound at +111% to surpass even 2019 sales!

This speaks to the strength of the wedding industry in Portland, which draws couples from all over New England, New York, and beyond (survey estimates 75% of Portland weddings are for couples from outside the MSA).

Larger economic trends for Portland are more positive, as well. Its trend for gross regional product (GRP) is different from the US total business sales, as well. Portland’s GRP remained fairly level in 2020 (+0.8%) but then grew rapidly in 2021 (+12.7%).

The number of weddings in Portland rebounded with considerable strength (+54%), but the 3,936 weddings in 2021 are below the 2019 total of 4,277. As in the US, average spending per event in Portland reached new highs in 2021 at $28,411 per event (+37% vs. 2020 or +15% vs. 2019).

Looking at the details of how spending has changed gives insight into developments in the wedding business community that has shaped or responded to this new environment.

Looking at the details of how spending has changed gives insight into developments in the wedding business community that has shaped or responded to this new environment.

Portland’s market analysis includes specific spending patterns for 15 major categories that help show which parts of the wedding might be most important for couples and gives some hints as to which items may be driving cost increases for overall wedding spending.

Focusing on major spending categories and seeing how they change over time gives us a clear picture of which goods and services have become precious in a post-COVID-19 wedding market. Spending is up more than 20% since 2019 on venue/location, photography, and wedding dresses. Entertainment/DJ and flowers/décor spending are both up more than 10%. Perhaps surprisingly, both big-ticket items related to food and drink are down compared with pre-COVID-19 spending.

One explanation for the reduced spending (price?) for food and drinks resulting from COVID-19 is the decreased demand for sit-down restaurants during this same period. A trend common across the US during the pandemic was a move away from traditional restaurant dining towards, well, every other kind of eating out: limited-service restaurants (take out), cafes, snack bars, and caterers. The same is true in the Portland area with sit-down restaurants closing (-3.6% from 2019-2021) while every other type of eatery is expanding (+10%).

Data used here for weddings and business trends is primarily through 2021 when the economy was just beginning to return to normal and consumer behavior was catching up from an extended doldrum. From January 2021 to September 2022, the US has seen staggering price increases as the Consumer Price Index (CPI) has grown almost five-fold from 1.7 to 8.2.

These changes in prices reflect a correction of sorts as money that would have been spent during the pandemic is now put to use. But there are structural changes afoot beyond this one-time consumption windfall that are now rippling through the broader economy as goods and workers continue to be in short supply.

The wedding industry, especially in Portland, has proven resilient in the face of a global pandemic. But while love never goes out of style, the way people celebrate love and the businesses that support it are facing novel changes during a time where more and more people are trying to get to the chapel without breaking the bank.