- Navigator

- Food and Beverage

- Expansion Solutions

- Industry Analytics and Strategy

This article originally appeared in the December 2024 issue of Expansion Solutions magazine.

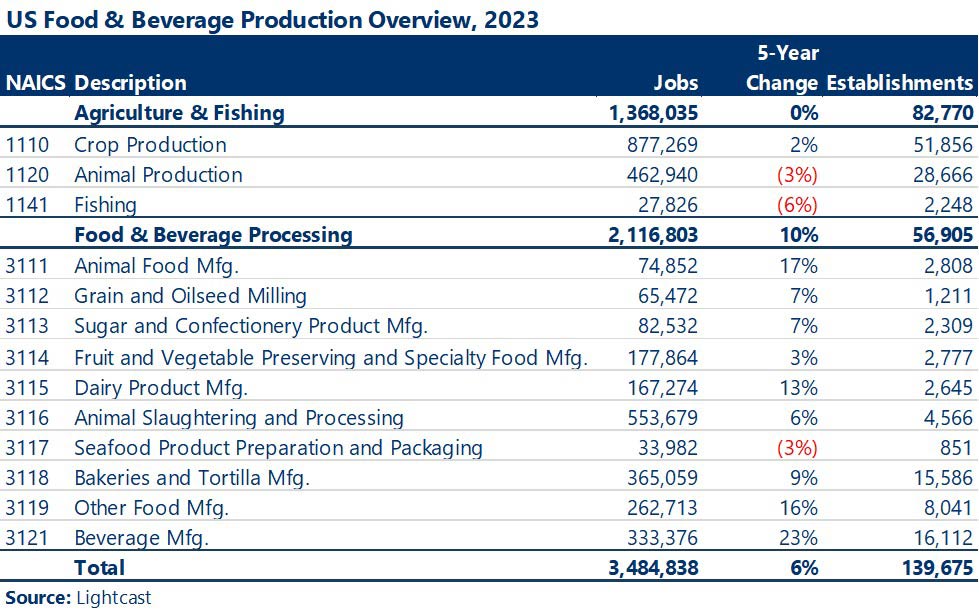

The Food and Beverage Production sector in the US is a significant contributor to the economy, accounting for nearly 3.5 million jobs and over $534.3 billion of GDP in 2023. This sector includes Agriculture, Fishing, and Food and Beverage Processing subsectors, with notable job growth in food manufacturing, particularly beverage production.

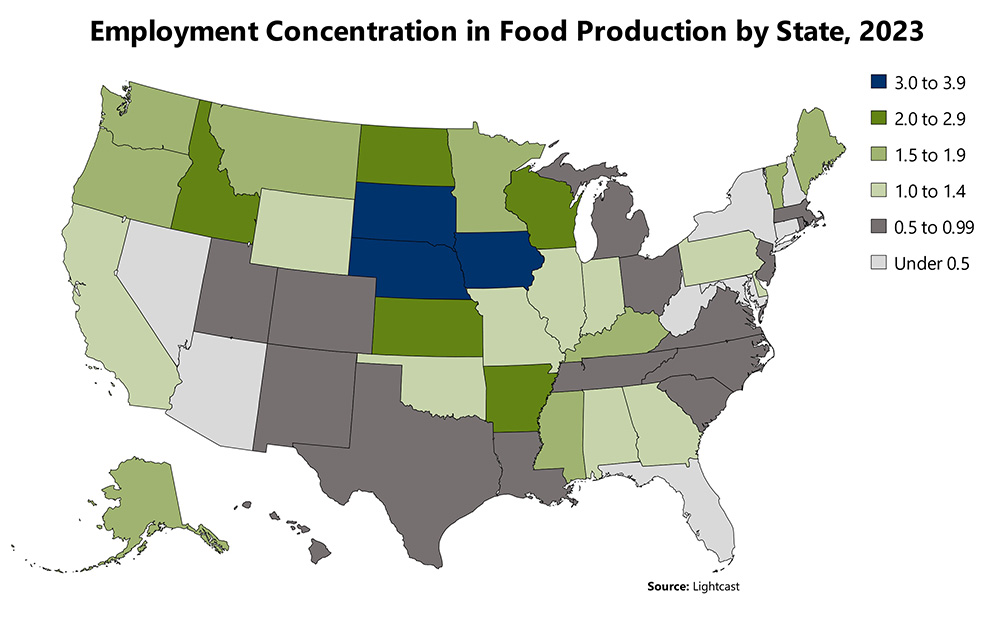

States in the Midwest lead in employment concentration within this sector compared to the US as a whole and are seeing billions in Food and Beverage Manufacturing investments in 2024 so far. Within 2024, cross-border capital investments in the Food & Beverage industry have surged, driven by both foreign and domestic companies.

The key to strengthening the Food and Beverage industry is investing in transportation and warehousing, especially in cold storage, to strengthen the supply chain and build a resilient food economy. Economic growth and food security stem from supporting technological innovation and adoption, improving transportation infrastructure, and encouraging capital investment.

Why is this the case? Where are employees concentrated in the US? Where are investments coming from and how can the industry position itself for growth? In this article, we provide the latest trends in the Food and Beverage Production sector and provide insights on how to support a growing industry.

Industry Overview

Job Growth by Subsector

The Food and Beverage Production sector in the United States accounted for nearly 3.5 million jobs throughout the United States in 2023, with an approximately 40%/60% split between Agriculture and Fishing vs. Food and Beverage Processing. The Food and Beverage Production sector contributed over $534.3 billion of GDP to the United States economy in 2023, 2.2% of the nation’s total GDP.

During the five years from 2018-2023, nearly all of the job growth occurring in the Food and Beverage sector was generated by Food Manufacturing subsectors, which together grew by 10% and added over 200,000 jobs, compared to almost no growth in the agriculture and fishing industries. Comparatively, job growth across all sectors in the US was 4% during the same time period. Beverage manufacturing is by far the subsector that grew the most over the last five years, adding over 63,000 jobs for a 23% growth rate. Breweries accounted for just over half of the growth in beverage manufacturing in the last five years.

Other high-growth subsectors are animal food manufacturing (+17%), the bulk of which was in the pet food manufacturing industry, as well as other food manufacturing (+16%).

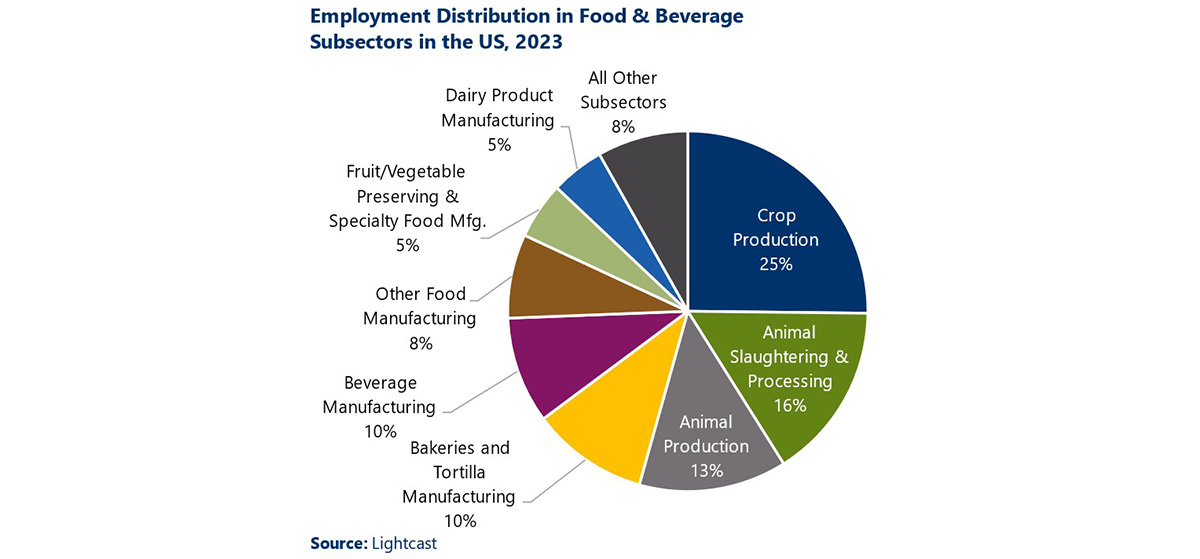

Employment Sector Distribution

In the United States, a quarter of all jobs in the Food and Beverage sector are in Crop Production, followed by 16% in Animal Slaughtering and Processing. Other key subsectors are Animal Production, Bakeries/Tortilla Manufacturing, and Beverage Manufacturing.

While the last five years have seen relatively little shift in the overall distribution of employment across subsectors, Beverage Manufacturing notably jumped from 8% to 10% of the sector, while Animal Production shifted down from 15% to 13% from 2018-2023. This signals that although most of the sector has seen relatively little disruption over the past five years, Beverage Manufacturing is growing rapidly, with many new products arising to meet changing consumer preferences. Examples include sparkling waters, non-alcoholic cocktail mixes, canned cocktails, and hard seltzers.

Concentration (LQ) by State

Several states stand out for having high Location Quotients (LQs), which are used to measure the intensity of a state or region’s employment concentration within a given industry. States in the Midwest – Nebraska, South Dakota, and Iowa – have the highest concentration, each with 3-4 times the share of employment in food and beverage production compared to the US as a whole. Other key Midwest states like North Dakota, Arkansas, and Wisconsin, along with Idaho unsurprisingly round out the top states for food and beverage production.

On the whole, states in the South tend to lag the rest of the nation in food and beverage production, with their economies focused on other industries. Only six of 17 Southern states (as defined by the Census Bureau) have an LQ greater than 1.0, with Arkansas being the only exception.

Major recent investments in states with strong employment concentration include the following:

- In February 2024, Switzerland-based Nestle announced a $175 million investment in Webster County, Iowa to expand manufacturing operations at a Purina PetCare plant

- In February 2024, Netherlands-based Bosch Growers announced a $50 million investment in Kentucky to establish a new greenhouse, which will grow and distribute bell peppers and berries for the US market.

- In April 2024, Japan-based Kikkoman announced an $800 million investment in two Wisconsin facilities, including a 22,300-square-foot new production facility to brew soy sauce in Jefferson and an expansion of its existing brewing facility in Walworth.

- In June 2024, Schwan’s, a subsidiary of South Korea-based CJ Corporation, announced an investment in a new 65,000-square-foot production facility and campus in South Dakota to produce foods under the company’s Bibigo brand. The facility will employ an estimated 600 people.

Recent investments point to the global nature of food and beverage production.

Recent Investment Activity in Food and Beverage Production

Food and Beverage Manufacturing

Key capital investment in the United States Food and Beverage sector for 2024 through July, by the numbers:

Key capital investment in the United States Food and Beverage sector for 2024 through July, by the numbers:

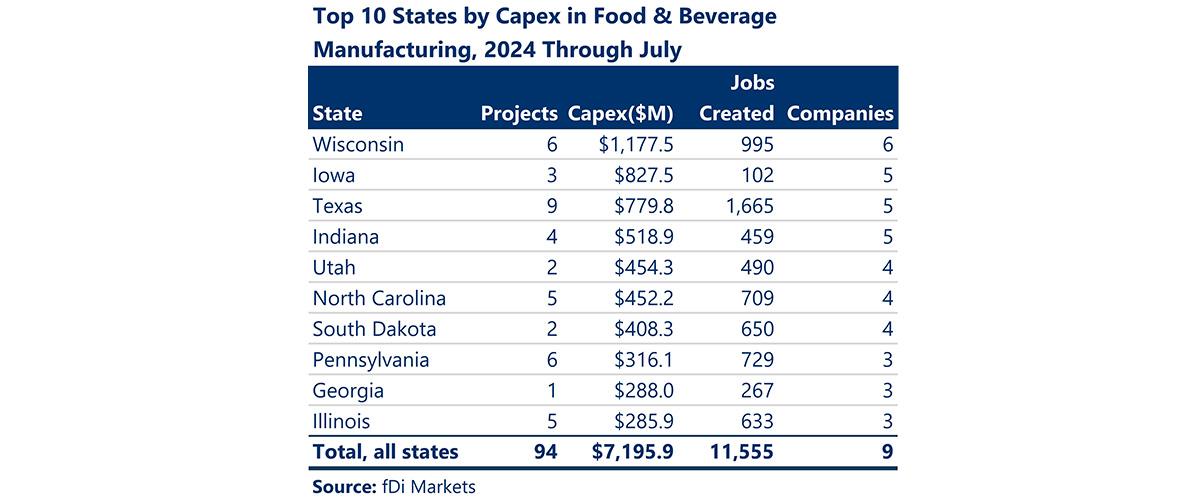

- $7.2 billion of total cross-border capital investment across 94 projects

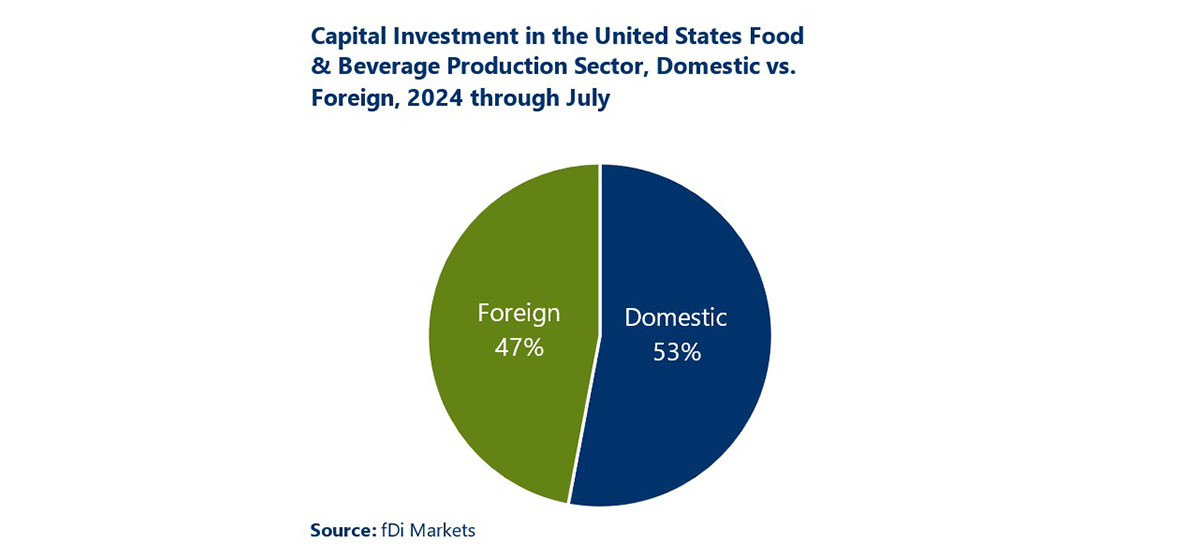

- 53% of investment is derived from domestic companies, with 47% coming from foreign sources

- Over $1 billion of capital investment each in Seasoning and Dressing, Fruit/Vegetable/Specialist Foods, and Dairy Products

In the first seven months of 2024, nearly $7.2 billion of cross-border capital expenditures across 94 projects were announced across the United States. Major cross-border capital investment is being driven nearly equally by foreign and US-based companies, with 53% of the cross-border capital flow being sourced by US-based companies and 47% from foreign companies.

Through July, Wisconsin attracted over $1 billion of capital investments in the Food and Beverage sector, with $800 million coming from Japan-based Kikkoman to expand soy sauce production. Meanwhile, other key states like Iowa, Texas, and Indiana have attracted over $500 million in investments each.

Alternatively, Texas is the top domestic origin of capital investment flowing into cross-border projects in the US so far in 2024, with Texas-based companies announcing $1.1 billion in investments across 5 projects. Other key domestic sources include New York, New Jersey, and Virginia companies. Key international investments in US projects derive from Japan, Switzerland, Canada, and South Korea. Japan-based companies alone accounted for $1.2 billion of capital expenditures announced so far in 2024, which is by far the largest international source.

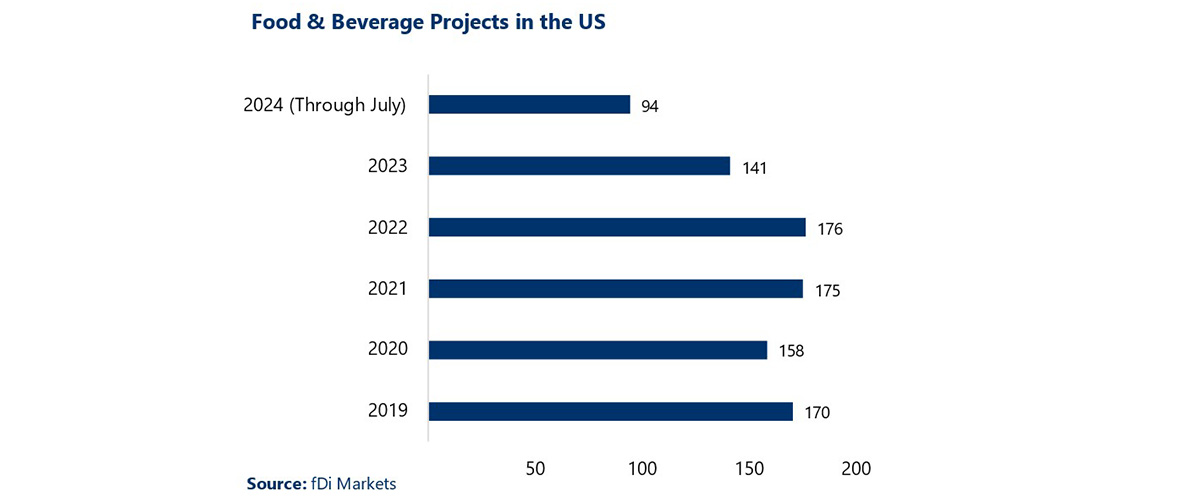

Over the last five years, capital investment in Food and Beverage projects has remained strong, although the number of projects dipped slightly in 2023. In the first seven months of 2024, the 94 projects announced throughout the country represent strong growth in capital investment, outpacing the same seven months of 2023 by about 15% and indicating that 2024 will likely be a strong year of development in the sector.

Key Investments in Warehousing and Distribution for the Food and Beverage Sector

Transportation and warehousing projects relating to Agribusiness have grown rapidly over the last five years. In 2019, only six cross-border projects focused on improving the supply chain for food and beverage products. In only the first seven months of 2024, that figure has ballooned to 22 projects across the United States. In 2024 so far, 16 of these projects (73%) relate to cold and frozen storage or transportation, representing a major sector for growth in the sector.

The demand for cold storage is high for several reasons. Over the past several years, multiple disruptions — from the COVID-19 pandemic to geopolitical unrest — have highlighted the need for a stronger supply chain and logistics system to transport our food supplies nationwide. Enhanced cold storage infrastructure helps to improve resilience to these disruptions, particularly for fresh and frozen foods.

Meanwhile, new advanced automation technologies have made cold storage developments more efficient, offering increased scale and volume for storage and more efficient logistics services at the facilities. For example, NewCold’s new facility in McDonough, GA, which opened in 2024, is able to utilize 42 meters of vertical space to store 85,000 pallets. Large-scale automated layer-picking done by seven double-stacker cranes enables this capacity. According to the facility’s press release in 2022, it represented a $333 million cold storage investment. Similarly, a newly opened Lineage cold storage facility in Hazleton, PA, will integrate advanced automation like cranes, rail-guided vehicles, and automated layer-picking to optimize the efficiency of the 386,000 SF facility.

Georgia, with an existing strength in transportation and logistics, is playing a major role in this new investment in transportation, logistics, and distribution projects related to agribusiness. Of the 22 total projects in the sector announced this year, seven originate from Georgia-based companies headquartered in Atlanta and Gainesville. Meanwhile, four of them involve projects that are set to occur throughout Georgia. Overall, half of all agribusiness-related logistics and distribution projects are either occurring in Georgia or being developed by Georgia-based companies.

Meanwhile, other established US transportation and logistics hubs like Kansas City and Chicago are also hotspots for new development in food and beverage logistics, with two new facilities near Kansas City and three near Chicago. These sites are being strategically positioned next to other major transportation infrastructure to allow for greater efficiency in distribution to major markets.

For example, a new CJ Logistics facility based 30 miles outside of Kansas City was strategically located due to its nearby access to both a major interstate and a transcontinental intermodal facility. This location will have the unique advantage of providing access to major markets while also allowing for significant cost-savings on logistics and greater shipping efficiency.

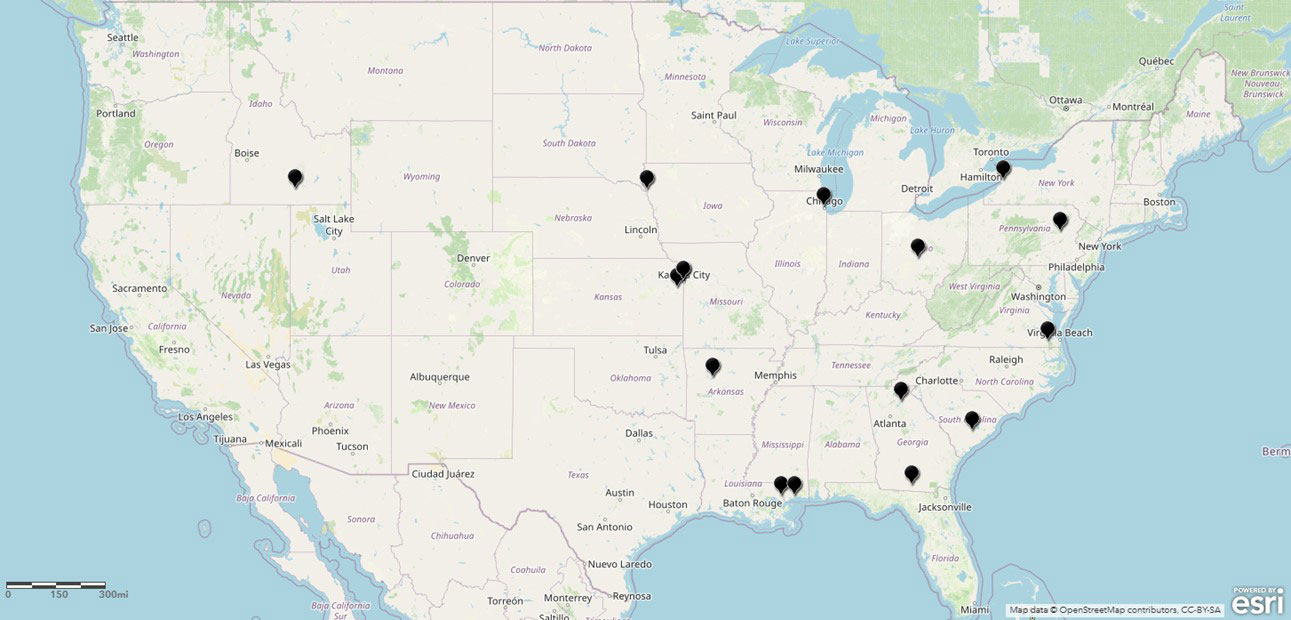

That said, developments are also occurring outside of major transportation and logistics hubs, as the map below demonstrates. Overall, 2024 announcements for investments in Cold Storage that will serve the Food and Beverage sector are primarily located along the eastern half of the US, with one exception in Boise, ID.

Investments in Cold Storage for the Agribusiness Sector, 2024 Through July

Recent announcements for cold storage and logistics investments in 2024 include:

- May 2024: CJ Logistics America, a subsidiary of South-Korea-based CJ Corporation, announced a new cold storage warehouse in New Century Kansas. This facility will contain 291,000 SF of warehouse and will be served by rail. The new facility will be attached to an existing Upfield plant, where it produces plant-based foods under brands like Country Crock, I Can’t Believe It’s Not Butter, and Imperial. Approximately 100,000 SF will be available for other customers to use.

- April 2024: Georgia-based Arcadia Cold announced three new cold storage facilities, with two in Chicago, IL totaling 600,000 SF and one in Charleston, SC, that will add 262,000 SF of cold storage. Combined, these three projects will add nearly 115,000 pallet positions. These facilities will serve clients such as food manufacturers, retailers, and service providers.

- February 2024: Atlanta-based Americold announced a $127 million project to develop a 335,000 SF temperature-controlled warehouse in Kansas City, MO. The facility will be a strategic collaboration with Canada Pacific Kansas City and will operate refrigerated rail service between Midwest markets and Mexico.

- March 2024: FreezPak Logistics, in collaboration with Karis Cold and L&B Realty Advisors, announced a new 245,400 SF cold storage development in Suffolk, VA, near the Norfolk, VA, port. The facility, which will have 35 loading docks, will support nearly 50,000 pallet positions. According to the press release, the site will offer other services such as blast freezing, cross-docking, LTL and FTL transportation, repacking, overseas container plug-ins, e-commerce, and USDA/FDA inspections.

Implications for Economic Development

Prioritizing the growth of transportation, warehousing, distribution, and logistics networks is essential to economic development. A lack of infrastructure and business support creates significant barriers to expanding business capacity and scalability. The Food and Beverage sector, in particular, requires timely and efficient transportation, cold storage, and accessible distribution networks in order to grow, maintain food safety standards, and comply with USDA guidelines.

- Communities across the US can take advantage of new innovations and increased foreign direct investment (FDI) in food and beverage production by helping existing businesses understand and adopt new technologies for greater efficiency.

- Strengthening the US supply chain for food and beverage processing promotes sustainable growth and enhances agribusiness through domestic job creation and increased investment.

- Value-added food products contribute to sustainable food ecosystems for local consumption and present opportunities for both domestic and international trade. Examples include yogurt, ice cream, pre-packaged salad kits, jams, and jerky.

- Investment in transportation, warehousing, and logistics options, especially in rural communities, can reduce costs that currently hinder business growth and product movement. Additionally, such investments support business attraction efforts by providing the infrastructure needed for incoming food and beverage producers and processors.

- Attracting foreign and global investment requires collaboration between regions, communities, and state and regional partners to develop effective strategies and conduct foreign direct investment and trade analyses.

Learn about our Industry Analytics and Strategy Services

📍 Related Articles: