- Navigator

- Expansion Solutions

- Industry Analytics and Strategy

- Life Sciences

This article was originally published in the May/June 2023 issue of Expansion Solutions Magazine.

This article was originally published in the May/June 2023 issue of Expansion Solutions Magazine.

The Life Sciences industry is contributing to high growth in economic output, jobs, and business creation across the United States. Much of this growth is based on emerging knowledge and technology that blends traditional life sciences with digital technology, advanced materials, and advanced manufacturing to create economic opportunities for workers, businesses, and investors.

Camoin Associates recently worked with several clients to help them understand trends and opportunities in Life Sciences-related industries and develop strategies and actions that leverage specific assets within their region for economic growth and prosperity. In this article, we share lessons learned in the course of our work and discuss how these lessons can apply to other organizations or geographies that are seeking to establish or grow their Life Sciences cluster.

National Trends in Life Sciences Industries

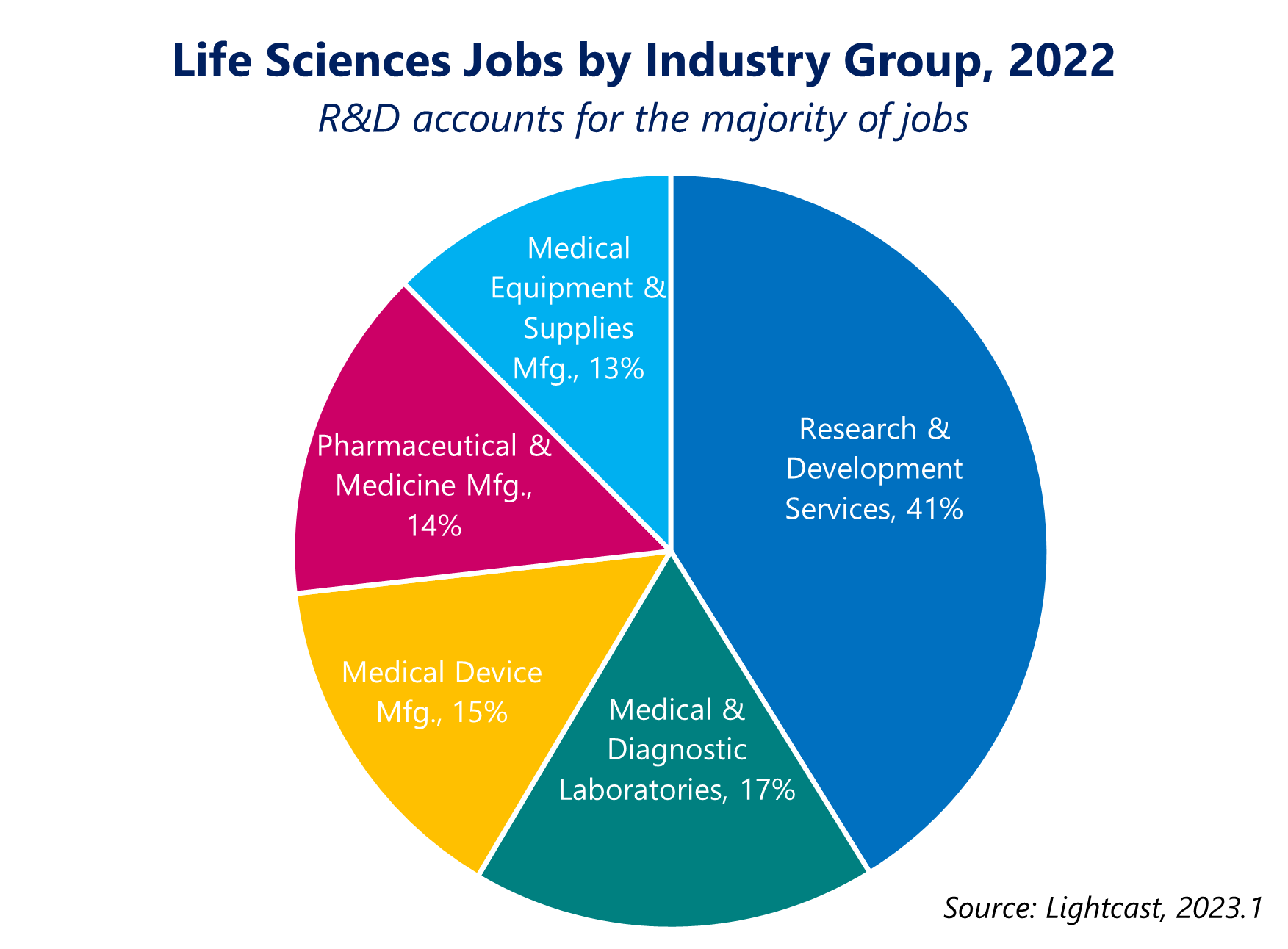

First, we acknowledge that the definition of Life Sciences can vary between locations. For the purpose of this article, we use a broad definition of the Life Sciences industry that includes a range of professional and technical services, along with the manufacturing of specialized products and materials. A typical breakdown of industry subsectors includes:

- Medical and Diagnostic Laboratories

- Medical Device Manufacturing

- Medical Equipment and Supplies Manufacturing

- Pharmaceutical and Medicine Manufacturing

- Research and Development

Among these industry groups are specialized sectors like healthtech (the integration of digital technologies and healthcare), animal and agriculture bioscience, personalized medicine, biofabrication, advanced regenerative manufacturing (production cells, tissues, and organs), and more. Based on this definition, there are nearly 2.4 million jobs in Life Sciences in the United States, accounting for about 1% of all US jobs.

Among these industry groups are specialized sectors like healthtech (the integration of digital technologies and healthcare), animal and agriculture bioscience, personalized medicine, biofabrication, advanced regenerative manufacturing (production cells, tissues, and organs), and more. Based on this definition, there are nearly 2.4 million jobs in Life Sciences in the United States, accounting for about 1% of all US jobs.

Growth Indicators by Industry Group

The national factors impacting the five industry groups noted above will have implications for communities or organizations studying their Life Sciences industry. While these factors are dynamic and fluctuate with the economic environment, a summary of the latest factors impacting the industry groups is presented below.

- Medical Device Manufacturing: Industry growth will be driven by demographic trends (the aging population), increased access to healthcare through expanded insurance coverage, and technology enabling new and improved products. Recent globalization of the market has caused increased threats from import competitors and additional emphasis on costs. Dollar valuation, geopolitical stabilization, and US attempts to re-shore manufacturing capacity will be external factors affecting success.

- Medical Equipment and Supplies Manufacturing: General increased demand for medical equipment should benefit from larger positive trends in health services demand, spending on research and development (R&D), and an aging population that is more reliant on visual aids. Exports and emerging markets should see growth from a weakening dollar and innovative product lines. A backlog of deferred services due to the pandemic will spur demand as the economy continues to normalize.

- Research and Development: R&D will benefit from positive headwinds by a supportive federal government, the return to normal for consumer and product development demand, and demographic trends whose health needs will require innovative Life Sciences solutions. The evolution and growth of private and non-profit/institutional segments should diversify growth opportunities and help weather near-term economic volatility.

- Pharmaceutical and Medicine Manufacturing: Demographics and consumer sentiment are moving in the right direction for a mix of sectors that have a track record (and current investment in R&D levels) for delivering innovative products. A changing regulatory environment and post-pandemic normalization of downstream industries will create opportunities for pharmaceutical manufacturing companies to maintain consistent growth. Market fundamentals, especially import competition and labor costs, are directing firms towards more niche and high-margin areas of drug research like therapy areas for rare diseases and oncology.

- Medical and Diagnostic Laboratories: Aging demographics and the demand from coronavirus and other diseases are keeping demand high for preventative and diagnostic screening. Additionally, deferred health services due to the pandemic combined with aging demographics have created a near-limitless demand for organ transplants.

By the Numbers

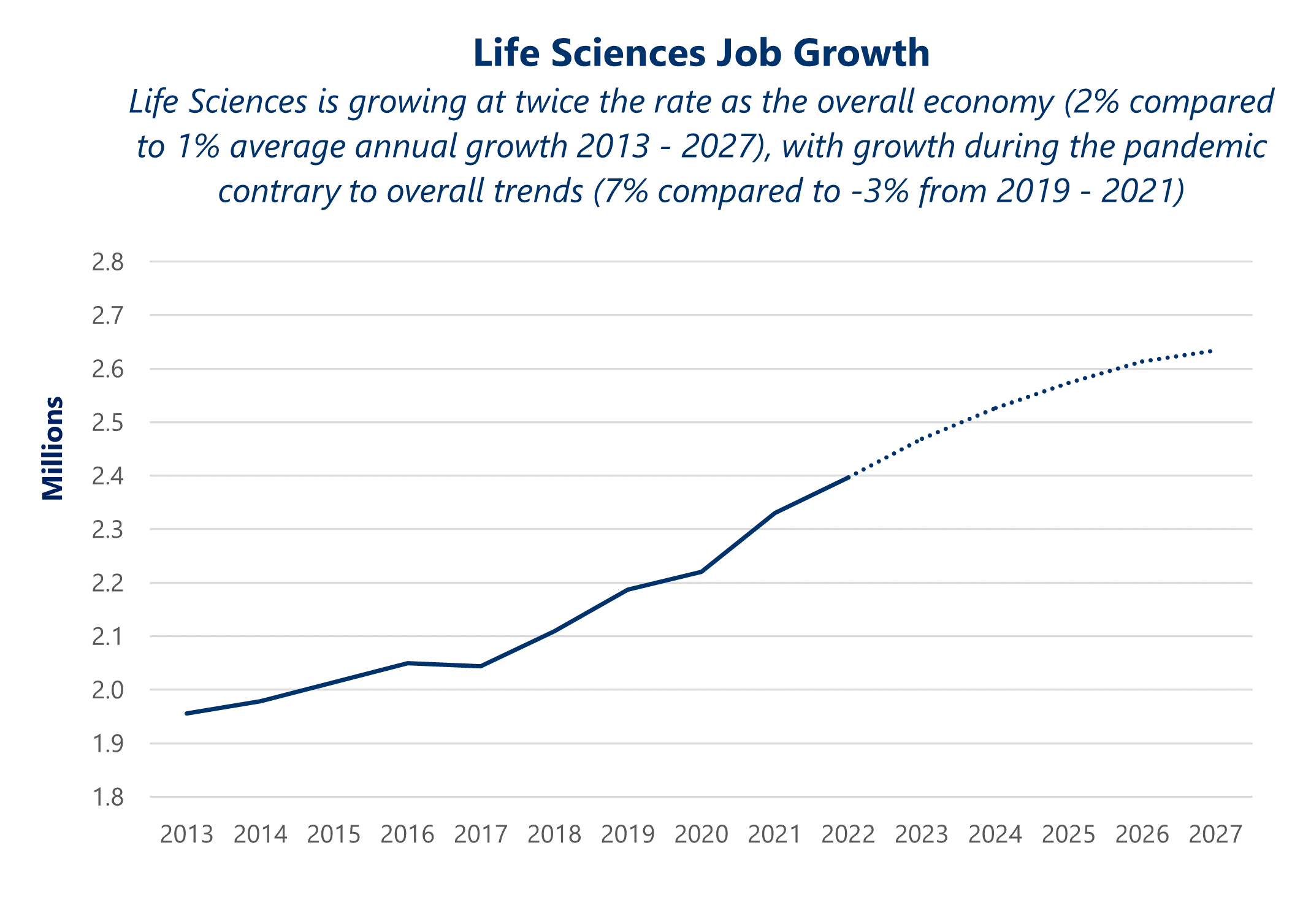

Life Sciences only accounts for 1% of jobs in the US but grew much faster over the past 10 years (23% compared to 16%) and has significantly higher average earnings ($65,522 more per year on average) than the overall US economy.

Common Connections in Life Sciences for Economic Opportunity

Camoin Associates has worked with the public and private sector to help organizations determine their niche for growth in the Life Sciences sector. In recent years, this work has included analysis and strategies in Michigan, Texas, Virginia, Florida, New York, New Hampshire, and Maine. Below, we present five practical lessons learned for economic and business development in Life Sciences.

1. Know Your Assets and Embrace Your Niche in the Life Sciences Ecosystem.

Life Sciences is a vast cluster with many subsectors. It is advantageous to champion the assets, talent, or skills that make your location stand out in a particular subsector. Build out the industry cluster around these characteristics, while looking for ways to expand beyond your original assets and diversify.

New Hampshire’s Life Sciences industry stakeholders are aware of the larger regional context that they operate in and use this regional context as an advantage. The southern border of New Hampshire sits about 40 miles from Boston, Massachusetts, which is now the largest Life Sciences cluster in the world. Functionally, New Hampshire is connected to the Boston metro cluster, yet has a distinct role and identity in Life Sciences. While the Boston metro is without a doubt a center for the latest in research and development, producing and manufacturing devices or pharmaceuticals can be much more challenging based on real estate availability and pricing. Companies have already sought out New Hampshire as a lower cost option for production, which keeps them within close proximity to their own R&D efforts or near to their suppliers.

Finding your niche may also mean filling a gap that exists in the current system. The Life Sciences industry analysis conducted by Camoin Associates for New York’s Capital Region revealed a critical gap in industry development: Moving beyond R&D to product and business development. This led to regional strategies and actions to support early-stage entrepreneurs and companies with technology transfer, licensing, and advancing to growth funding.

Established in 2015, the Biomedical Acceleration and Commercialization Center at Albany Medical College (BACC) formalizes the support that is needed to get from discovery to production licensing and growth funding. The BACC’s “Innovators in Residence” program is specifically designed to help biomed entrepreneurs move from the patent disclosure phase into the growth and venture capital stage, also known as the “valley of death.”

2. Know What’s Coming Next. Go Beyond Recent Industry Trends for Future Growth Sectors.

Innovation in the private sector continues to drive the industry towards possibilities that would have seemed completely outlandish just 10 years ago. From 3D printed organs to gene therapy, this technology isn’t some far-off consideration. This is work that is happening now and it has the potential to revolutionize daily health as we know it. Yet, the ability to support the most life-changing research and manufacturing requires dedicated workforce training and funding to capitalize on this transformative technology.

In New Hampshire, regenerative manufacturing and biofabriciation are thriving subsectors that are truly transformative in the Life Sciences sector. The City of Manchester was awarded $44 million in one of the US Economic Development Administration’s Build Back Better Regional Challenge grants in September 2022 to advance this field. States and organizations that embrace working with the private sector to prepare for not just the technology of today but for the next two decades and beyond will prove more competitive than their counterparts.

Looking to the future also requires an understanding of the importance of digital technology in Life Sciences. Another example in New Hampshire comes from the northern part of the state, where Dartmouth College’s strength in computational sciences and its medical school makes the region highly competitive for healthtech; this includes the convergence of healthcare services and research with digital technology. As a result, this has become a business expansion and attraction focus for the state.

In Loudoun County, Virginia, the presence of dense computing technology, digital assets, and related talent have made it a leader in data centers within the US. These assets, along with transportation and logistics resources, have led the County to focus its Life Sciences attraction efforts on the cross-section with information technology. This includes emerging opportunities in healthtech and highly specialized/high-value-add medical manufacturing. This targeted focus has led to success stories for the County where businesses have received venture capital to expand their efforts.

3. Workforce, Workforce, Workforce.

While every industry has been impacted by problems attracting and retaining talent for positions at all levels, the need is particularly acute in Life Sciences. In some cases, there is a sense that all positions in this field require advanced degrees and the reality is that there are jobs in clean rooms that require no more than a high school diploma. Debunking perceptions of this field and bringing opportunities to students in the K-12 school system will be key to fueling the next decade of growth in Life Sciences.

Best known for its role supporting Michigan’s automobile industry, Lansing is still growing into its reputation as a Life Sciences leader in the state. It was noted many times throughout stakeholder interviews conducted by Camoin Associates that new recruits may be hesitant to move to the area for a position related to Life Sciences for fear that they may not have any other options if something were to happen at their original position. Yet, the region is home to over 270 Life Sciences businesses and holds significant opportunities for someone advancing in their career. The private sector in Lansing is working closely together to cross-promote opportunities and hold joint-career fairs to actively demonstrate the breadth of the cluster.

4. Understand the Components of the Supply Chain and Where Opportunities May Lay.

Industries’ supply chains play critical roles in sustainability and growth potential. Locations with a connection to supply chains and related transportation and logistics often determine regional competitiveness for location and investment.

Tallahassee, Florida, is home to the National High Magnetic Field Laboratory, the Mag Lab, which includes the largest and highest-powered magnet laboratories in the world. This turns out to be a critical component for Life Sciences, as magnets and magnetic technology are core to MRI machines. At the Mag Lab, medical researchers and scientists use powerful magnets to investigate disease and develop instruments and techniques to reveal the structure and behavior of complex proteins, pathogens, and biological processes. Understanding the valuable role of magnetics technology in both research and the medical device supply chain, Tallahassee’s Office of Economic Vitality focuses its targeted industry attraction efforts on entrepreneurs and companies that can benefit from connections to world-leading R&D and applied development through the Mag Lab.

Transportation and logistics within supply chains play critical roles in company investment and location. Loudoun County, Virginia, is home to Dulles International Airport, which plays a critical role in attracting high-value manufacturing companies in Life Sciences. These products, including specialized medical and surgical instrumentation, are typically shipped via air. Close proximity to Dulles International Airport translates to ready access to global markets for Life Sciences businesses.

5. Organize, Collaborate, and Know Your Role.

There is no single organizational structure that will support Life Sciences. The relationships and context of stakeholders in the public, private, non-profit, philanthropic, and educational sectors will influence where leadership is best centered. Regardless, a distinct entity or organization to organize members, messages, and initiatives will drive success. Active industry partners are imperative to the success of any Life Sciences organization.

While industry-led initiatives are imperative as a part of a Life Sciences cluster, the public sector has an important role to play and can maximize its support by focusing on the levers that they have power over. This includes the following categories:

Facilities and Real Estate

- Supporting or partnering on critical R&D assets like accelerator space, incubator space, and laboratories

- Site development

- Special development districts and zones

Financial Assistance

- In business attraction

- Discretionary grants

- Early-stage financing

- Investment tax credits

- Equipment and machinery financing

- Multi-disciplinary research grants

- New jobs tax credit

- R&D tax credits

- SBIR/STTR match

- Seed financing

- Single sales/use refunds

Talent and Workforce Development

- Certificate and degree programs

- Employer-based skills development

- Internships and apprenticeships

- K-12 education outreach

- Academic talent/research recruitment

- Industry talent recruitment

An example in Houston, Texas, comes from the Urban Partnerships Community Development Corporation (UP CDC), a nonprofit whose mission includes bringing jobs and economic development to low- and moderate-income neighborhoods.

Not traditionally an industry economic development organization, UP CDC saw a need and opportunity for real estate redevelopment in Houston’s East End that addressed both business and workforce development. Through their development of the East End Maker Hub, they created a place where individuals, entrepreneurs, and companies can locate and/or use shared manufacturing space and equipment. The space is located within the Life Sciences cluster in Houston, which is bolstered by the Texas Medical Center (TMC) and TMC Johnson & Johnson Innovation Lab (JLABS). The East End Maker Hub is anchored by TXRX Labs, which provides training and support as well as direct services to members.

Identifying a great demand, the East End Maker Hub welcomed Life Sciences companies in need of flex space as they grew and scaled their operations beyond start-up. Recognizing the growing demand for flex manufacturing in Life Sciences, UP CDC is further exploring expansion to nearby properties within the East End.

In Lansing, Michigan, bringing together a cross-section of stakeholders helped determine and solidify the roles of each partner in cluster development. For the regional economic development organization, Lansing Economic Area Partnership (LEAP), it became clear that they were the entity with the greatest capacity and leadership to advance site readiness, real estate acquisition, and development partnerships. They also took on the role of identifying and marketing the Life Sciences brand for the region. Recognizing how and where the private sector would lead initiatives, as well as where Michigan State University could harness its R&D and make additional connections to commercialization, LEAP set out a path for all stakeholders to see how their work contributes to the overall vision of growing the industry.

There are many facets to how and why the Life Sciences industry will flourish. These five lessons provide the foundation for the elements that need to be analyzed and integrated into your industry initiatives.