- Navigator

- Featured Indicator

- Industry Analytics and Strategy

- National

- Retail, Services, and Accommodations

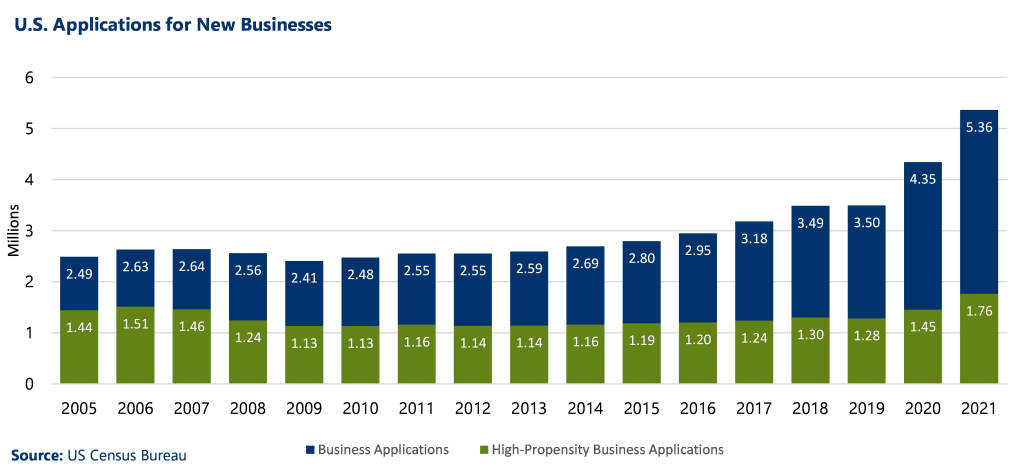

According to the US Census Bureau’s Business Formation Statistics, new business applications are up — way up. Widespread pandemic-driven layoffs served as fuel for an explosion of new startups, which reached record highs in 2020. The upward swing then continued into 2021, breaking the previous year’s record.

From 2005 to 2016, 2.5 to 3 million new business applications were coming in each year. These figures slowly began trending upwards in the latter part of the last decade but surged more than 24% to over 4.3 million in 2020. New business applications then jumped by another one million applications (23%) in 2021, to reach nearly 5.4 million.

From 2005 to 2016, 2.5 to 3 million new business applications were coming in each year. These figures slowly began trending upwards in the latter part of the last decade but surged more than 24% to over 4.3 million in 2020. New business applications then jumped by another one million applications (23%) in 2021, to reach nearly 5.4 million.

The Census Bureau’s new business application data is based on business owner filings for new Employer Identification Numbers (EIN) with the IRS. The Census Bureau also uses this information to determine which of those applications are most likely to grow into companies with an employee payroll. These enterprises are categorized as high propensity business applications, and those are also up significantly, climbing more than 50% from levels seen ten years ago to reach 1.8 million in 2021.

What the Data is Telling Us

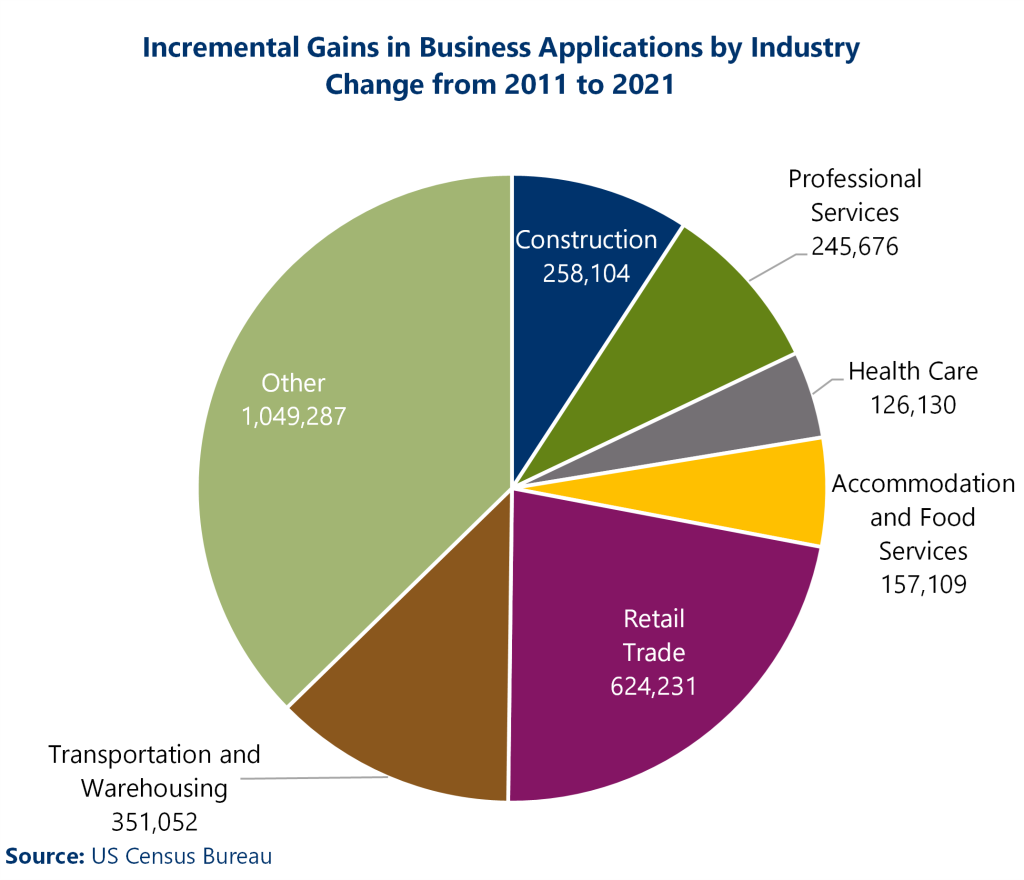

Far and away, the greatest source of increased business applications has been seen in retail.

When the pandemic forced many stores to close and the number of laid-off workers swelled, this sector grew by 175% from its 2011 level, propelled by a surge in entrepreneurial sellers. Indeed, from 2019 to 2020, new retail businesses alone accounted for 59% of the total increase in applications received by the IRS.

Within the retail sector, however, the increase in high propensity business applications was significantly more muted, edging up a more moderate 39% from 2011 to 2021. This indicates that the great majority of these applicants are sole proprietorships — likely retailers without a brick-and-mortar store selling their goods online and delivering directly to their customers.

A strong showing was also seen in transportation thanks to a tremendous ramping up of ridesharing during the pandemic; and in warehousing, possibly due to the dramatic rise in goods being delivered directly to consumers. Similarly, the number of applications for professional services providers also showed strong increases.

A strong showing was also seen in transportation thanks to a tremendous ramping up of ridesharing during the pandemic; and in warehousing, possibly due to the dramatic rise in goods being delivered directly to consumers. Similarly, the number of applications for professional services providers also showed strong increases.

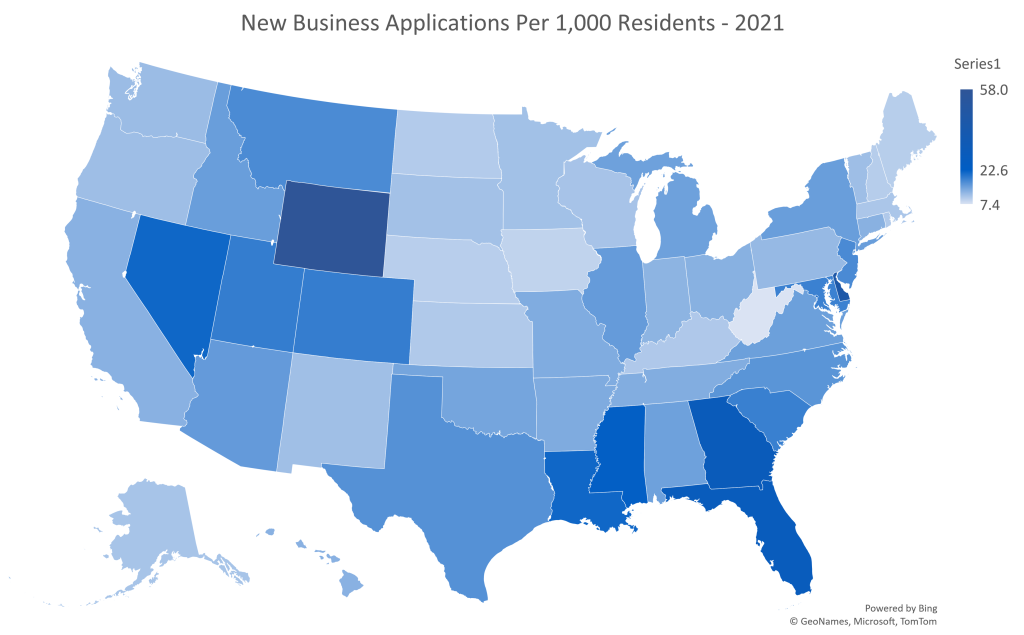

The data also provides an interesting geographic view of entrepreneurship. Likely the favorable tax environment found in Wyoming and Delaware played a role in these states posting the highest rates of new business applications per capita. Also registering amongst the highest on this scale were Nevada and Washington DC — two locations that experienced some of the highest unemployment rates in 2021.

Southern states also saw a high number of new business applications per capita, which may be the result of less restrictive COVID-19 policies/requirements.

Why Data About New Business Applications Matters

While the pandemic-driven rise in unemployed workers supplied the fuel for this recent surge in new business applications, technology surely provided the oxygen.

Workers interested in the autonomy and flexibility found in self-employment have successfully leveraged online marketplaces, social media, and on-demand business tools to connect with suppliers and customers and manage the shipment of goods. The Census Bureau’s new business applications data illustrates just how enthusiastically entrepreneurs have entered this space.

The lag from first obtaining an EIN to eventually making the first employee payroll can span eight quarters or more (a separate data series in the Census’ Business Formation Statistics). But young, small firms have been found to make the largest contribution to net employment change, according to the US Bureau of Labor Statistics, and this recent growth in new business applications carries with it strong prospects for healthy business growth to come.