- Navigator

- Industry Analytics and Strategy

- Retail, Services, and Accommodations

For economic developers, there are a lot of mixed messages about the retail sector.

On the one hand, the sector has received some notable, yet grim, airtime in recent years. We saw home goods giant Bed Bath & Beyond file for bankruptcy in April 2023 — the latest in a series of major retail closures over the last decade.

In addition, following rapid growth in shopping from home during the COVID-19 pandemic, a January 2023 report from McKinsey & Co. predicted that the retail and consumer goods industry would spend more on automation over the next five years than any other industry, which is significant given that job creation is a major piece of the economic development profession.

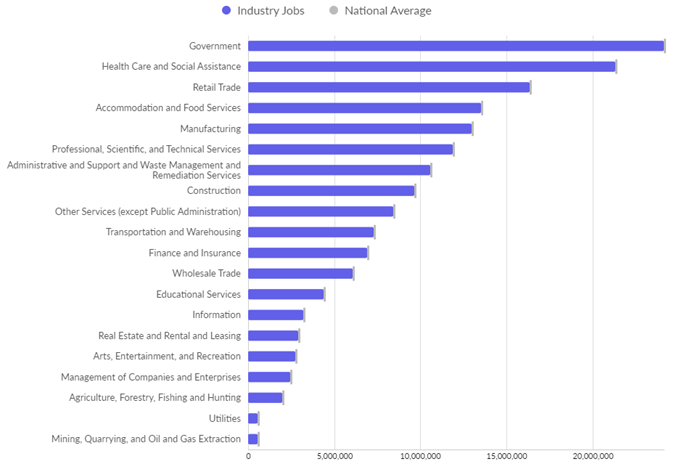

On the other hand, retail employs a lot of workers. Despite questions about the potential impact of automation on job growth, there were over 16 million jobs nationwide in the Retail Trade industry alone. The sector ranks third in employment only after Government and Health Care and Social Assistance.

Largest Industries in the US by Number of Employees (2022) Source: Lightcast (Q2 2023)

Source: Lightcast (Q2 2023)

While big box stores and online retailers undoubtedly drive retail employment (Lightcast data showed Walmart as the top job poster in 2022, with Amazon coming in at number three), small businesses represent another side of the retail coin. At Camoin Associates, we work frequently with our clients on understanding and strengthening entrepreneurial ecosystems, small business supports, and placemaking — all elements that intersect with retail, and all factors that can drive inclusive economic growth.

So, why should economic developers think about a retail strategy as a tool to help communities succeed? And, perhaps more importantly, how should they think about the role of retail in creating a positive impact for residents and workers?

In this article, I’ll take a more nuanced look at the retail sector: What it is, how to measure it, and how economic development professionals might include it in their suite of strategies.

To help make sense of everything, I had a conversation with Bobby Boone, Founder and Chief Strategist at &Access, a community retail expert, and one of Camoin Associates’ current project partners.

What is Retail?

According to IBISWorld, a company specializing in industry research, “The Retail Trade sector is the final step in the distribution of merchandise to end consumers and includes retailers operating through brick-and-mortar locations, online selling, and omnichannel. Merchandise sold by retailers is purchased from suppliers and is then sold to consumers through the retailers’ stores or other mediums. Though not formally a retail subsector, restaurants, other eating and drinking places, and other services are also included in the retail industry cluster.”

Practically speaking, when &Access is working with communities, the team talks about retail as storefront businesses where you can walk in, purchase a good or service, and walk out; or, as an experiential retail activity (e.g., House of Vans flagship store in London with an indoor skatepark). Boone described three categories that are definitive in terms of consumer behavior and can help clients understand the scope of the retail sector:

1) Neighborhood Goods and Services: These include grocery stores, barbers, dry cleaners, salons, spas, etc. They are things you do in your neighborhood most often, and spending decisions are based on proximity. If you’re running a weekly errand, you’re probably prioritizing convenience, price, and quality depending on your household needs.

2) Food and Beverage: This is anything you eat and drink outside of your home. There is a variable element at play with food and beverage establishments — e.g., maybe you choose a coffee shop that is closest to the office because you need some last-minute caffeine to get through an upcoming meeting. Or perhaps you’re making a restaurant reservation a month in advance for a special event.

3) General Merchandise: This includes furniture, apparel, and everything you’ll find in a mall, strip mall, and big box stores. General merchandise consumers base spending decisions on comparison shopping. This is the retail category that is primarily being disrupted by e-commerce: It is a highly competitive landscape and is more reliant on factors like price rather than convenience.

Why Consider a Retail Strategy?

Retail does not always get the best press, especially from the worker perspective of long hours and the employer perspective of high attrition. How should economic developers be thinking about retail in the context of equitable economic prosperity given some of the headlines that we often hear about the sector?

“[Retail] is very much so a contradictory industry as it relates to equitable economic development. It has these indicators, which don’t necessarily equate to good jobs, stability, etc.” Boone shared. “But from an equity perspective, entrepreneurship is often a route to career stability for populations that may otherwise face high barriers to entry into the workforce, whether they are immigrants, returning citizens, or individuals without higher education attainment.”

The potential of entrepreneurship as a pathway to economic mobility for underserved populations — combined with the reality that society relies on goods and services — means that communities can develop retail strategies to cultivate more inclusive economic growth.

Measuring Retail

There are several measures that economic developers can include in the research phase of a project to understand their community’s retail landscape. &Access typically considers the following metrics:

- Population Base: This provides information on a community’s socioeconomic base and how its population moves throughout a given area. The analysis can include household composition, household size, the number of cars available, and how people travel to and from work within a neighborhood. Areas with high bike and public transportation use likely indicate a higher concentration of localized sales, which can mean a more retail-friendly environment.

- Expenditures and Income: All neighborhoods have retail expenditures and demand. The consumer expenditure survey reveals what people are spending daily on retail goods and services in a geographic area. Researchers can look at the expenditure total divided by various metrics of sales per square foot to gain insights about demand and square footage supported in a community. That information is available from national brands. Researchers can also look at rent-based metrics and extrapolate them into various sales projections to better understand retail demand.

- Employees: This data sheds light on a community’s employee base to help economic developers be realistic about potential retail customers in a particular area. Measures can include employee count and industry representation.

- Visitors: In many communities, retail establishments are natural destinations for visitors. Economic developers can look at metrics like daily room occupancy, the number of rooms per hotel, and how much people are spending locally on meals and establishments. Together, these data points can help economic developers understand how to make retail establishments compelling to visitors within a neighborhood.

Retail Strategy Considerations

For economic developers who believe a retail strategy will support their community, Boone offered several considerations that will likely shape this work:

Automation, E-commerce, and Delivery

Economic developers often face tradeoffs when developing strategies, and trends like automation add yet another layer for communities to consider. For economic developers designing a retail strategy, it is important to think about how emerging technologies might impact jobs and wages.

As Boone noted, “People are figuring out ways to streamline getting goods and services in consumers’ hands. That supports the ability to potentially pay higher wages … but if you’re mandated to have higher wages by minimum wage standards in your specific state, that could mean fewer employees and more [reliance on] automation.”

Equitable Opportunities for Culturally Relevant Goods and Services

It is important to examine the right business mix for your community. According to Boone, “If we’re looking at entrepreneurship as an equitable opportunity and recognizing that retail is a pathway to that, how can we most directly align this with cultural needs in respective communities?”

&Access describes culturally relevant businesses as those that demonstrate a specific culture as part of the goods and services they sell (e.g., a retailer selling traditional garb). When a retail business is culturally relevant and minority-owned, economic developers will want to consider how to support and retain those businesses rather than relying on a national brand or big box store to fill the retail need.

At the same time, it is important to ensure that minority-owned businesses that are not culturally relevant are still successful and competitive in the area. Many regions are home to organizations that can provide services and resources to these businesses.

Business Expansion and Contraction

From a retail perspective, we hear a lot about business closures and less about business expansions. Boone emphasized that it is important for economic developers to be clear and realistic about targeted brand recruitment strategies. Be sure to examine site selection criteria, and to use facts and numbers to set communities up for a potential win.

Resources can include US Securities and Exchange Commission reports and company annual reports. These reports may showcase expansion efforts and provide economic developers with guidelines to make the case for their community’s alignment with a company’s expansion profile.

Boone also noted that economic developers have an opportunity to work with government affairs representatives at expanding companies to leverage incentives and discuss how local expansion can support the company’s brand.

Placemaking

Finally, the most successful retail strategies will have a place component. For more than half a century, development focused on homogenized suburban shopping centers that now face the highest risk of disruption due to e-commerce. Creating a compelling sense of place can play a significant role in retailers’ ability to capture customers.

Economic developers can support this by aligning retail opportunities with natural intersection points within the community — e.g., a transit stop, community center, or public library. Communities that link placemaking projects to broader efforts around commercial corridor design can yield even greater economic impact.

All in all, economic developers committed to inclusive growth and entrepreneurship may benefit from enhancing projects with retail strategies—or, at the very least, a retail analysis. To learn more about what this could look like in your community, make sure to check out &Access and the work they are doing to create retail real estate solutions for historically excluded entrepreneurs and under-invested neighborhoods.

Camoin Associates is a national leader in using research and data analysis to help communities and organizations understand where they are now and develop actionable, equitable goals designed to get them where they want to be. Learn more about our Industry Analytics services.