- Navigator

- Industry Analytics and Strategy

- Real Estate Development and Housing

- National

- Retail, Services, and Accommodations

In the final article in this two-part series, we take a look at trends indicating a return to normalcy and changes in retail real estate needs resulting from the pandemic.

Read Part 1

A Return to Trend

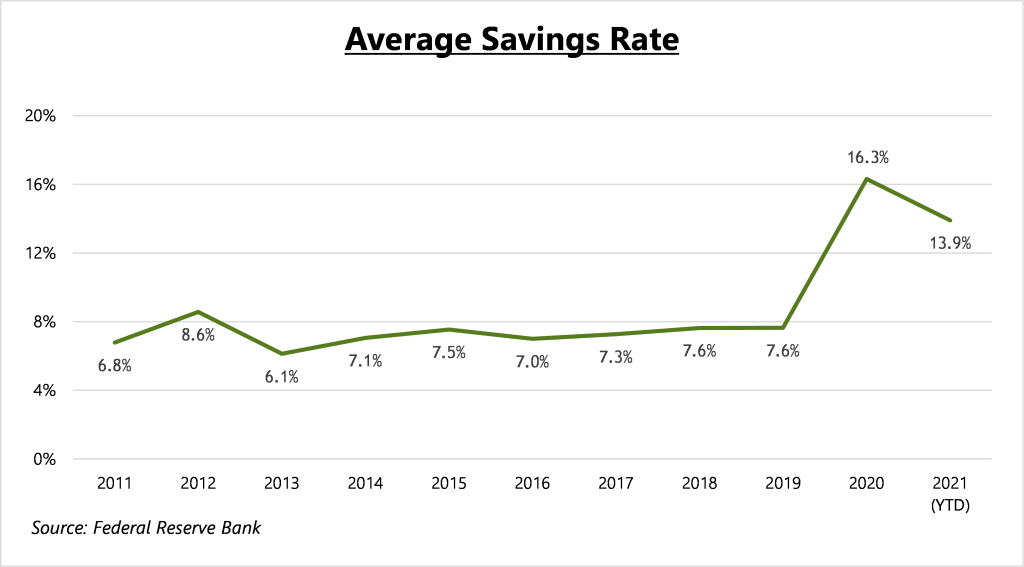

With the rollout of several COVID-19 vaccines, the first half of 2021 saw the start of a return to normalcy in the retail sector. Consumers became more comfortable coming out of their dens, bringing with them a healthy load of pent-up demand. Aside from binge watching streaming video, many households had also spent the prior year socking away their cash. Putting the brakes on spending meant raising bank balances, which also got a boost from payments coming from the CARES Act and other federal stimulus programs. By the end of 2020, the nation’s savings rate bounded to 16.3%, more than doubling the 7.6% seen in 2019 and reaching a new all-time high (the previous record being 13.5% set in 1971).

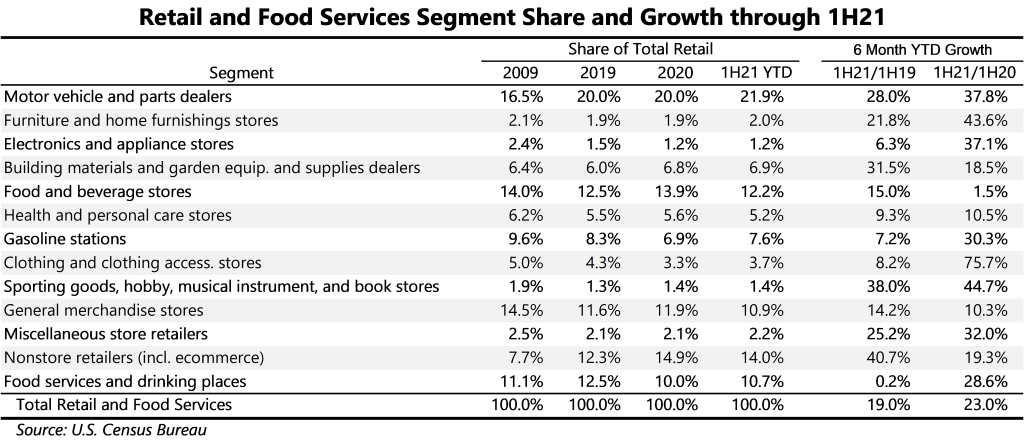

With all that cash burning a hole in their pockets, Americans returned to stores in droves—be it electronically, brick and mortar or hybrid. The spigot started to open in the first quarter of 2021, with year-over-year sales of retail and food services jumping by 14.2%. The floodgates really opened in the second quarter, which saw a full 31.8% year-over-year rebound. All told, year-to-date sales through June 2021 were not only 23% above their 2020 level, they registered a full 19% above the total seen over the first six months of 2019! Of course, these figures reflect spending in nominal dollars and a portion of the recent increase is attributable to supply chain bottlenecks and worker shortages driving up prices. Despite the impact on total sales accounted for by inflation, this nevertheless registered as an exceptional surge in spending.

Just as each of the retail segments felt the 2020 downturn differently, the rebounding sales of early 2021 were similarly uneven. Both auto dealerships and furniture sellers saw above average growth over the first half of the year, though their overall share of retail and food services spending remained within historic boundaries. For electronics and clothing stores, on the other hand, the above-average gains were welcome but, in truth, their shares continued their secular downward trend, still registering well below the pace seen in 2019. Likewise, health and personal care store and general merchandisers continued to watch their share of shopper’s dollars decline. Shoppers were out in force—just not at the malls.

To some degree the bounce back in spending represented a shift back to shopping in the real world, but online markets hardly suffered over the first half of 2021. Although non-store retailers’ share of spending dipped slightly compared to the 2020 surge, at 14% it still stood well above the 2019 pace (12.3%). While recent gains in ecommerce may have moderated recently, likely these retailers will continue to score an increasing proportion of consumer dollars going forward.

For restaurants and bars, a segment that suffered one of the most severe declines in 2020, an eager if hesitant return of diners (and to a lesser extent, drinkers) brought welcome relief. Through the first half of 2021, food services and drinking places bumped up their share of retail spending to 10.7%—still down significantly from the 12.5% rate seen in 2019 but a modest move back towards its previous state, nevertheless.

Prior to the COVID-19-induced slowdown, eating and drinking establishments had shown slow but steady gains, but their path going forward seems less certain. Yes, patrons have begun returning to restaurants but the pace of further recovery rests on people’s continued comfort gathering in closed spaces. A variant-driven resurgence of the COVID pandemic could easily undercut that sense of well-being and shift the focus back to the take-out menu.

Giving the People What They Want

While fast and easy may rule some portion of consumer’s shopping, the secondary use of the market as a meeting place has not disappeared even if COVID-19 has recently put a damper on this role. People are social animals and there remains a desire to connect with each other outside of the home and office.

One of the emerging concepts around retail is to serve as a venue where consumers come to enjoy a positive experience that makes them want to return. This is “experiential retail” where the focus is on customer engagement, not sales. The store becomes a place where people come to interact with the goods and where a vendor’s brand and culture are front and center. On the cutting edge of this model have been Apple Stores but many others have since followed their lead.

So, what does this mean from the real estate perspective? To the extent that retailers are pivoting to serve in part as fulfillment centers, an increasingly large portion of their square footage may be used not as showroom space but for warehousing. Owners should not be surprised when tenants look to re-negotiate leases with a reduced footprint. The amount of space per store is also expected to decline and a retail center may need to be reconfigured to accommodate a greater number of tenants.

An example of this shift to a smaller footprint is seen with Nordstrom Local. The retail giant has shifted its focus for new development away from their full-line stores (closing 16 in 2020) while simultaneously building out its new “Nordstrom Local” service hubs. The concept behind these 3,000-square-foot spaces is clearly on experience and service, emphasizing three core offerings—online order pickups and returns, alterations (done on-site), and style advice and tailoring. Though not quite as modest in their footprint, a similar concept is behind the new Market by Macy’s and Bloomie’s stores, both weighing in around 20,000 square feet.

Quality restaurants are also seen as an increasingly vital draw to a successful retail area. All consumer segments enjoy dining out and that doesn’t happen in a virtual space. This plays directly into the broadening concept of retail that is oriented around socializing and experiences—even more so when combined with consumer’s other preferences, including walkability and an amenity-rich setting.

The cuisine-oriented extension of experiential retail is the emergence of the “food hall.” Whereas most standard food courts may be indistinguishable from one another, hosting the same collection of national fast-food chains, a food hall serves as a venue for showcasing local entrepreneurial chefs. Popping up in refurbished spaces with unique character, such as old warehouses, train stations or mill buildings, the food hall becomes a destination in its own right, rather than simply a source of quick fuel to keep shoppers shopping. Added attractions might include cooking classes, foodie-focused retail, sports-themed bars, and arcades.

Hoping to capitalize on these growing trends, municipalities and communities are also reorienting around the evolving preferences of consumers (both residents and visitors). This includes providing added outdoor public space alongside pedestrian-friendly, car-free streets. It also means making permanent the curb-side pickup spaces that were hastily arranged in the early months of COVID-19. In areas that are significantly over-stored, there may also be opportunities for conversion of retail space to other uses. In particular, transforming older stores to residential units further strengthens an area’s consumer base. What’s more, it also deepens the feeling of community—just what shoppers are looking for.