- Navigator

- Expansion Solutions

- Industry Analytics and Strategy

- Healthcare and Social Assistance

- Manufacturing

This article originally appeared in the January/February 2024 issue of Expansion Solutions Magazine.

The Medical Device industry stands at the forefront of innovation, catalyzing groundbreaking advancements that redefine how and where people access everyday medical care. The industry is experiencing an unprecedented surge of excitement and transformative developments. From state-of-the-art diagnostic tools to revolutionary therapeutic devices, the Medical Device sector is not only meeting the evolving needs of healthcare but also shaping the future of medicine.

In recent years, the confluence of cutting-edge technologies, regulatory support, and a growing demand for personalized healthcare have propelled the industry into an era of exciting opportunities. The intersection of artificial intelligence, robotics, and precision medicine has given rise to a new generation of medical devices that not only enhance the efficiency of diagnostics and treatment but also pave the way for more targeted and patient-centric approaches.

And yet, the last three years have proven to be rocky for the Health Care sector, as operators attempt to recalibrate and stabilize from the economic fallout of the pandemic. In this comprehensive analysis of the Medical Device industry, we will explore its recovery in terms of investment; imports/exports; where activity is concentrated in the US; and what innovations are propelling growth in an industry where each advancement brings us closer to a future where healthcare is not just reactive but predictive, personalized, and profoundly impactful.

Medical Device Industry Overview

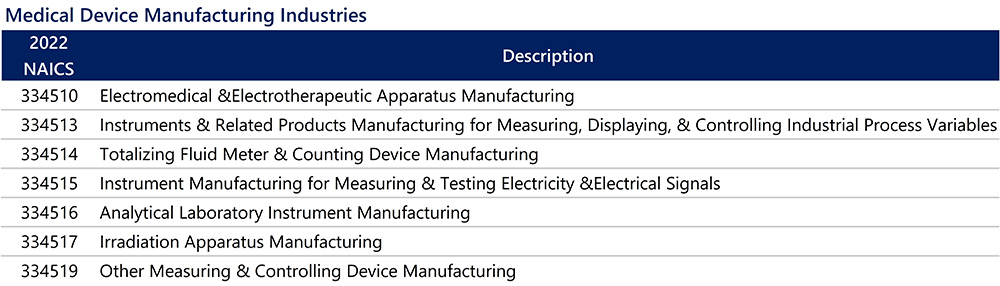

For this article, the Medical Device industry is defined by seven NAICS codes, as noted in the chart below. The Medical Device industry includes sectors that crossover with Advanced Manufacturing, which makes hardware that typically integrates electronics for use in medical devices.

Medical devices are typically used in hospitals, doctor offices, nursing and residential care facilities, and diagnostic labs.

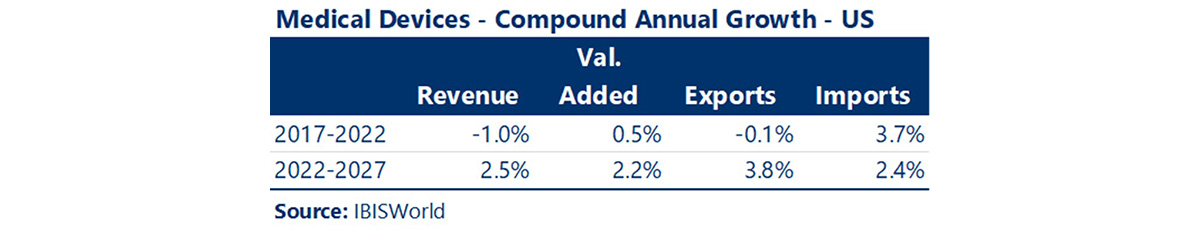

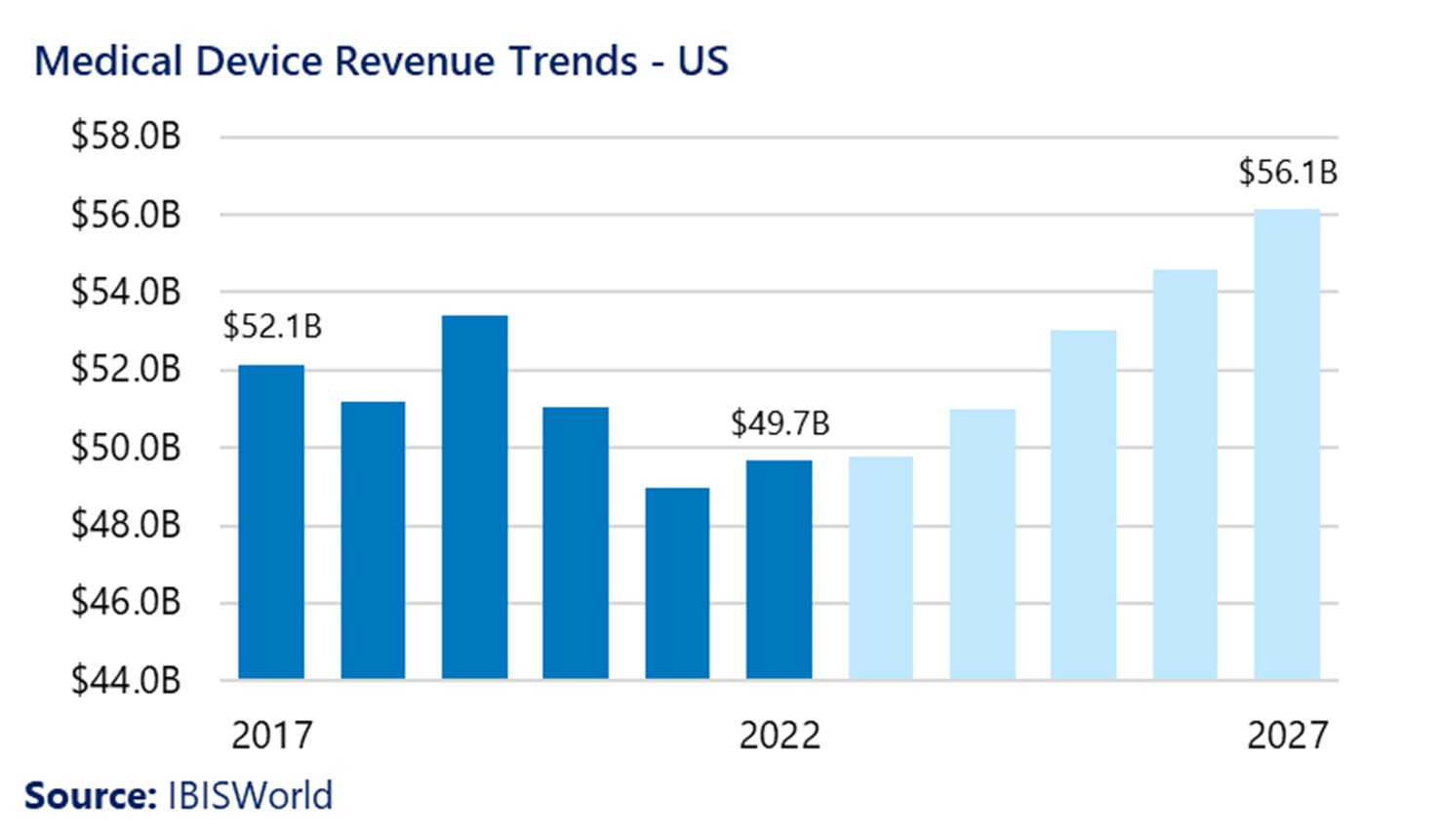

The last five years were marked by slow growth in the Medical Device industry, resulting from COVID-19 impacts as well as supply chain issues. Today, the industry has experienced a resurgence and is poised for higher levels of growth and opportunities. Revenue growth in the US is projected to increase at a compound annual rate of 2.5%, which will be accompanied by increases in value-added production and exports.

One factor driving growth is the continued aging of the population, leading to an increase in demand for specialized medical procedures and care. Additionally, innovative technology is creating novel applications for medical devices. Some of the emerging uses within the medical device field include the ability to personalize medical diagnostics and care to meet individual patient needs and conditions, as well as advanced sensing and monitoring that make applications more effective and safer for patients to use.

Medical Device Exports and Imports

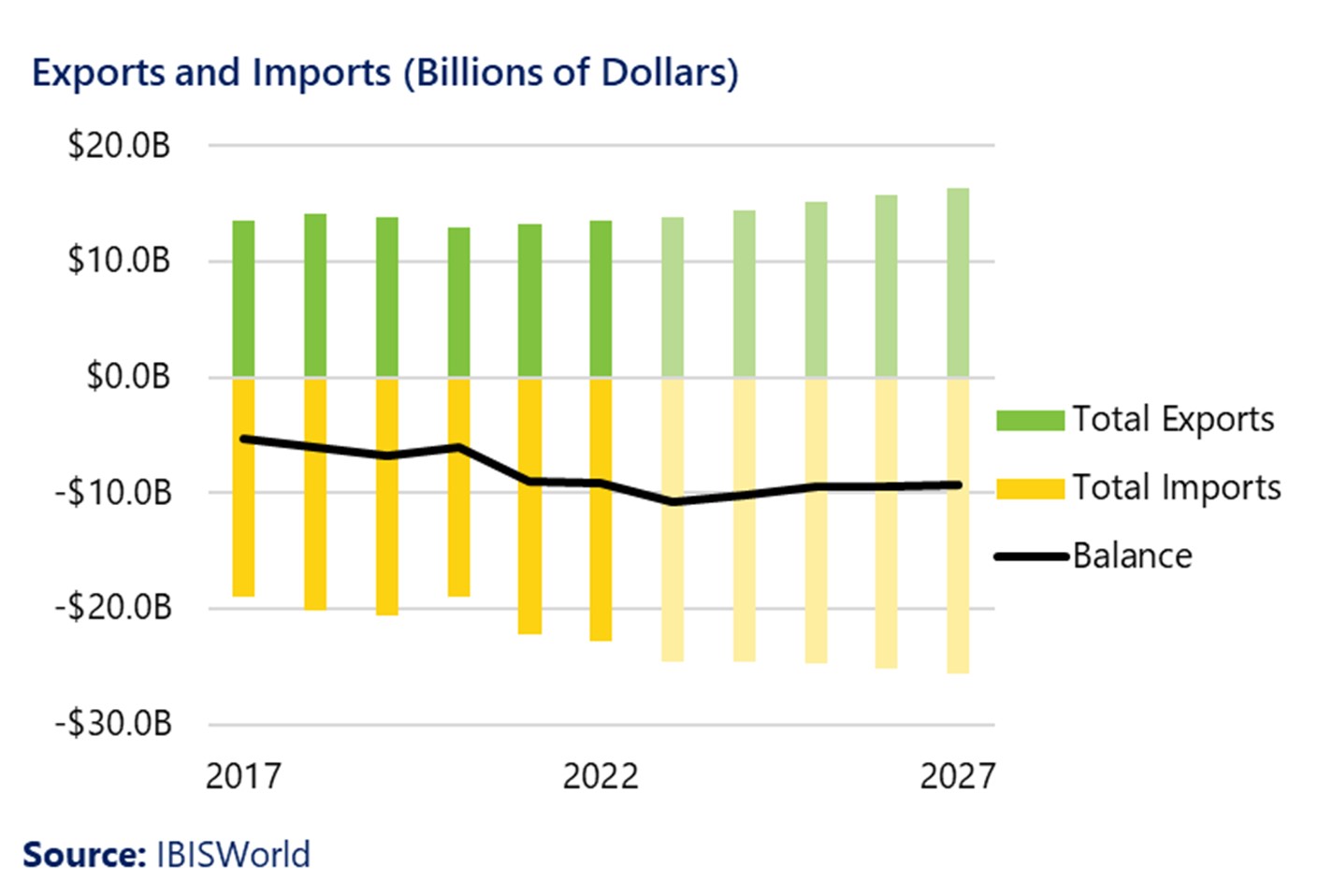

With improvements in the supply chain following the pandemic, exports of medical devices have increased in the last two years, reaching $13.9 billion, and they are projected to increase to about $16.6 billion by 2027. The US exports most of the medical devices it manufactures to China, Japan, the Netherlands, and Germany.

It is expected that medical device imports will continue to exceed exports through 2027, although at relatively stable levels over the next five years. The US imports the greatest quantities of medical devices from Germany and Mexico.

Venture Capital and Capital Investments in Medical Devices

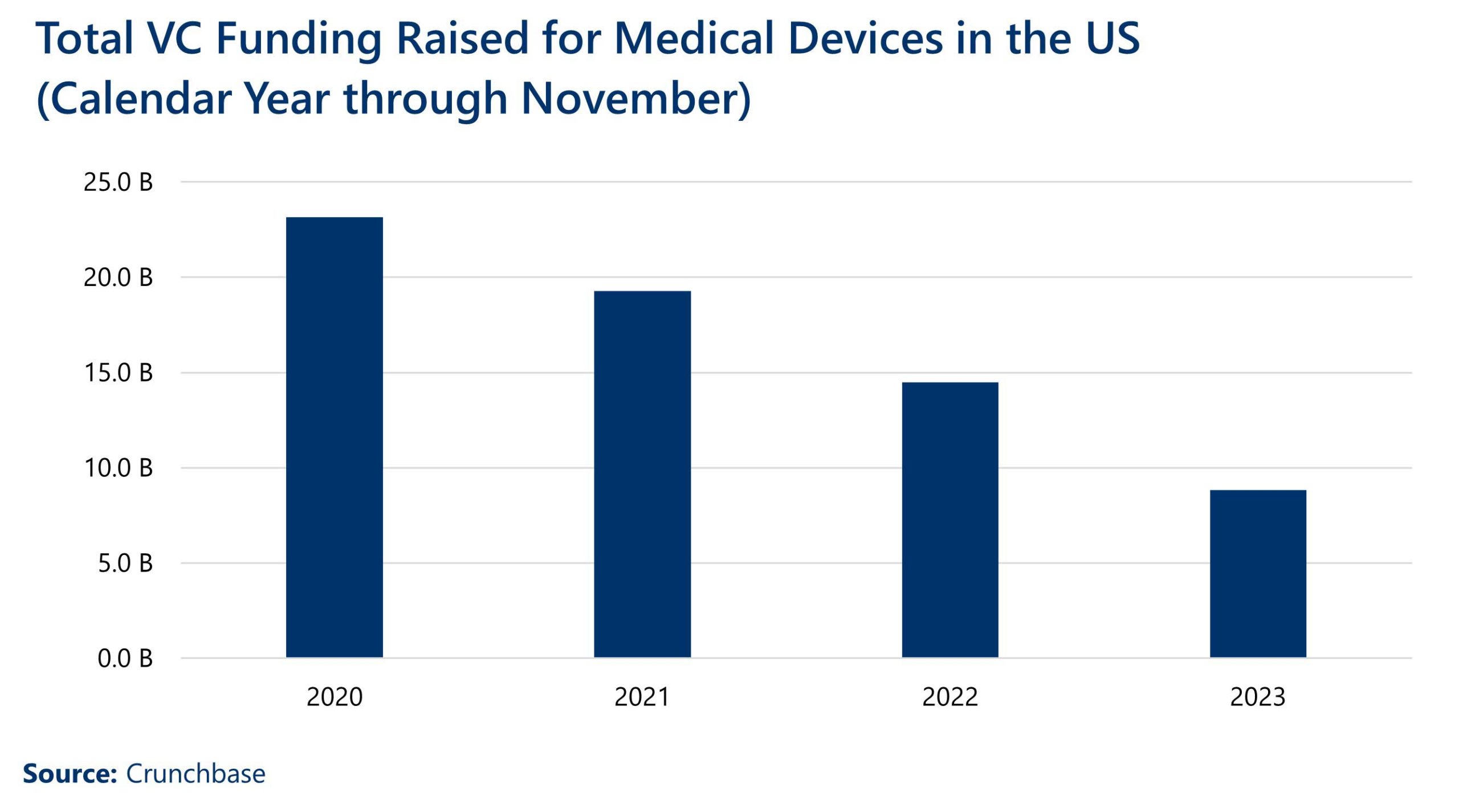

The pandemic also took a toll on venture and capital investment. Medical device startups raised $8.8 billion (USD) in venture capital in 2023, falling nearly 62% since 2020.[1] The industries that are most associated with startups receiving venture capital funding for medical devices are Health Care, Biotechnology, Health Diagnostics, Manufacturing, and Artificial Intelligence.

In the last three years, capital investment in the Medical Device sector has been on a downward trend, falling from $1.6 billion in 2021 to $535.7 million in 2023.[2] Since October 2020, 153 deals have been made in the US Medical Device sector, totaling over $4.5 billion in capital investment and creating an estimated 17,000 jobs. A vast majority of that investment represented domestic deals, meaning investment flowing between US states. 80 investment deals ($3.1 billion) came from within the US, while Malaysia ($350 million), Japan ($312 million), Switzerland ($179 million), and the United Kingdom ($158 million) were foreign countries with major capital investments in the US for medical devices.

The projected recovery and growth of the industry are likely to increase venture and capital investment, however, rising industry costs will remain a concern for investors. While there was already upward pressure on the inputs into the industry, the pandemic exacerbated this trend, cutting industry profits and driving up prices for end users. Intense rounds of research and development and clinical trials also drive up the cost of many medical devices. However, investors are generally cautious and want to see measurable results before making large investments.

Another factor that will influence investments in the Medical Device industry includes the recent US legislation, specifically the Inflation Reduction ACT (IRA) which sets new guidelines for medical devices as well as other components of the healthcare system (Hogan).

The Landscape of Occupations in the Medical Device Industry

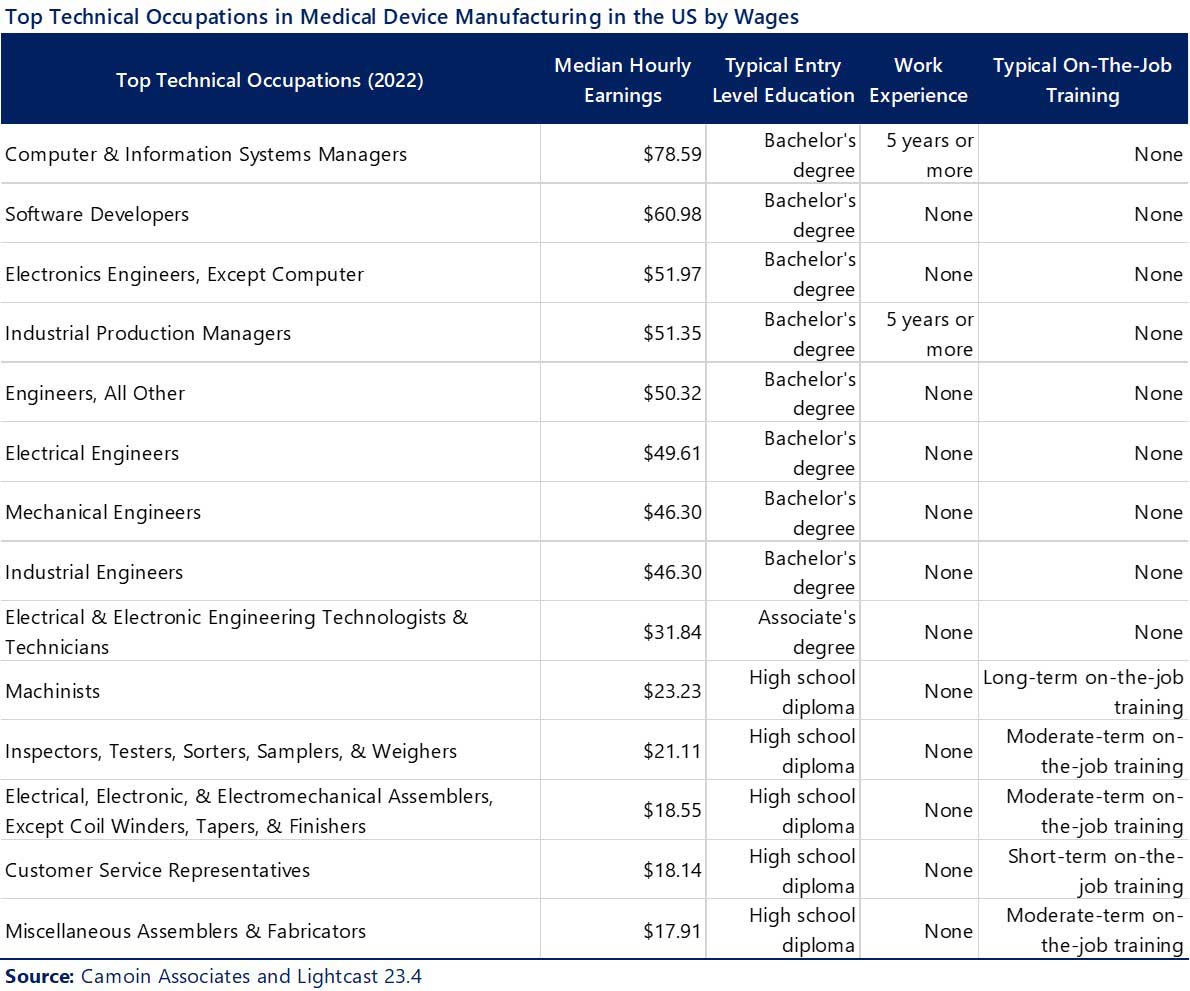

The Medical Device industry contains a mix of employment that is representative of highly technical occupations (engineering, computer scientists) that require higher education degrees, but also include manufacturing specialists (machinists and technicians) that require associate degrees and/or post-high school technical certifications and on-the-job training.

The Geography of Medical Device Employment in the US

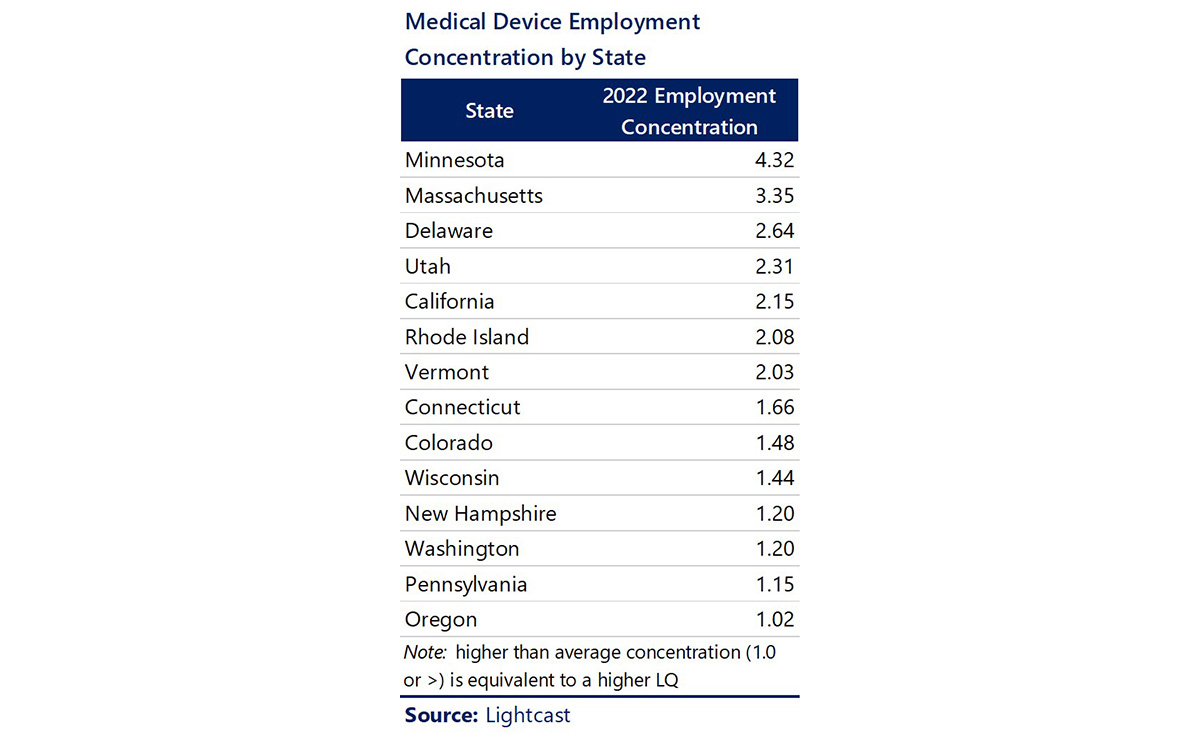

Based on 2022 employment figures, Minnesota has the highest concentration of jobs in the Medical Device industry, followed by Massachusetts, Delaware, Utah, California, Rhode Island, and Vermont. The top 25 states by employment concentration are noted in the table.

Recent developments reflect Minnesota’s leadership in medical device activity. This past October, the Minneapolis-Saint Paul Economic Development Partnership was designated one of the inaugural Tech Hubs by the US Department of Commerce. The Partnership’s proposal, Minnesota MedTech 3.0, aims to position Minnesota as a global center for “Smart MedTech.”

The recent opening of Ascential Technologies in Blaine, Minnesota, showcases the cross-over between life sciences manufacturing within the state. The company opened a 100,000-square-foot factory that focuses on custom automation for medical device manufacturers and employs 150 people. The facility is part of Ascential’s commitment to innovation, community development, and enabling businesses to repatriate manufacturing capabilities, supporting the resurgence of American manufacturing. Ascential’s customer base includes 3M, Medtronic, Abbott, and Boston Scientific[3].

Additional activity in Minnesota this year includes Zeus, a global leader in advanced polymer solutions, which celebrated its grand opening of a new catheter manufacturing facility in Arden Hills, Minnesota. The 75,600-square-foot building will house CathX Medical, acquired by Zeus in 2021. The facility includes an advanced research and development lab and cleanroom equipped with the latest technologies to design, develop, and validate new medical catheter prototypes. It also brings additional capabilities in-house to Zeus, including laser cutting, ablation, and welding”[4]. The Arden Hills location was chosen for its easy access to local transportation and amenities for the company’s expanding workforce.

Another state on the list, New Hampshire, is also making a name for itself as a tech hub and advancing an array of medical device manufacturing. The Advanced Regenerative Manufacturing Institute (ARMI) was designated as the “ReGen Valley Tech Hub” and aims to invest in manufacturing facilitates and incubate technology startups to further build the emerging field of regenerative therapy development and biofabrication.

Noteworthy developments in the Medical Device industry extend beyond the states that have high existing concentrations, as well. In the summer of 2023, Paragon Medical opened a $16 million additive manufacturing facility in Pierceton, Indiana, which specializes in the 3D printing of medical devices. The facility is expected to create 15 jobs and reduce lead time, costs, and supply chain complexity across the Medical Device industry. Paragon plans to invest an additional $19 million over the next five years[5].

In Michigan, the Lansing Economic Area Partnership (LEAP) continues to support its MedTech cluster and recently completed its 2023 Ascend MedTech Accelerator program. The program brought innovative companies with medical devices and other healthcare innovations to the Lansing region to further their research and commercialization phases. It was also an opportunity for the companies to work directly with the region’s large healthcare system, Sparrow Health System, and discover the real-world applications of their medical device or product.

Technology Trends in Medical Device Manufacturing

The future of the Medical Device industry is highly tied to the ability of companies to develop wearable devices with related technologies that deliver precise and personalized information using cloud-based data and analytics.[6] The methods of delivering this personalized information differ based on the patient and type of treatment and several examples are documented below.

The Rise of Wearables: Wearable medical devices that are inconspicuous and help treat chronic illnesses, diagnose ailments, or attack infections are a notable segment of this industry. In some cases, the technology is integrated into an already existing product or procedure. This includes items like smart contact lenses, which not only correct vision imperfections but can also distribute medicine to relieve allergies or measure blood sugar levels for people with diabetes.

Research is currently underway for several iterations of an augmented reality lens, which can be used to display real-time information directly on the user’s lens.[7] In some instances, data from wearable medical devices can even be transmitted directly into a user’s electronic records, updating in real time to ensure that medical professionals have the latest information at their fingertips when making decisions about a patient.

Personal Data to Diagnosis: The Medical Device sector is following the wider Health Care industry in the field of precision healthcare, where individualized care or a treatment plan is developed through intelligence collected by digital tools and reported back to clinicians to assist in their decision-making process.

Yet, as data and software tools increasingly shape how medical devices are used by medical professionals, the safety and privacy of this information will be a growing field to watch. The FDA has issued recent guidance for how “clinical decision support” (CDS) software should be used and stored in compliance with HIPPA regulations and even what type of software meets the threshold to be considered CDS.[8]

Drug Delivery Systems: Consistent with precision and personal care is the continued development and application of medical devices for drug delivery systems in individuals. As new drugs continue to be developed and specialized these delivery systems will be increasingly in demand.

Assistive Robotics: The advancement and integration of robotics is also positively impacting medical device innovation and demand. This includes robotics for assisting in surgery as well as patient medical care.

What This Means for Economic Developers

- Medical device manufacturing has become significantly integrated with information technology and analytics. It is therefore critical for regions to assess and develop their IT and analytics talent/workforce. Minnesota and its designation as a tech hub provides an excellent example of this intersection, as its strength in manufacturing runs parallel to its strength in data science and analytics for healthcare including bioinformatics.

- Given the past challenges within the supply chain, which still exist to some extent, those regions that can foster supply chain infrastructure — such as airports, cargo, and crossroads of trains, rail, and ports — are going to be competitive locations for new projects and expansions.

- With the soaring costs faced by industry operators and a history of tight profit margins, economic development organizations that can help companies lower development costs and attract and retain a skilled workforce will provide a competitive advantage.

- Given the specialization and innovation that occurs in the Medical Device industry, it is important for economic and business developers to stay up on current trends. A few places you can go to familiarize yourself with the industry include the Medical Device Manufacturers Association (medicaldevices.org) and the Advanced Medical Technology Association (www.advamed.org).

_________________________________________________________

[1] Through November 2023, Crunchbase

[2] fDi Markets Database, figures reflect totals through October 2023

[3] https://www.assemblymag.com/articles/98156-medical-device-company-opens-minnesota-factory

[4] https://www.zeusinc.com/company/news/zeus-celebrates-grand-opening/

[5] https://www.insideindianabusiness.com/articles/paragon-medical-opens-new-manufacturing-plant

[6] Medical devices 2030, https://kpmg.com/us/en/articles/2023/medical-devices-2030.html

[7] https://www.aao.org/eye-health/tips-prevention/smart-contact-lens-tech-beyond-vision-correction

[8] 202 Life Science and Health Care Horizons, https://brochures.hoganlovells.com/hogan-lovells-lead/ls-hc-horizons-2023?pid=MzA304097&p=2&v=1.1

Learn more about Camoin Associates’ Industry Analytics and Strategies services

📍 Related Articles: